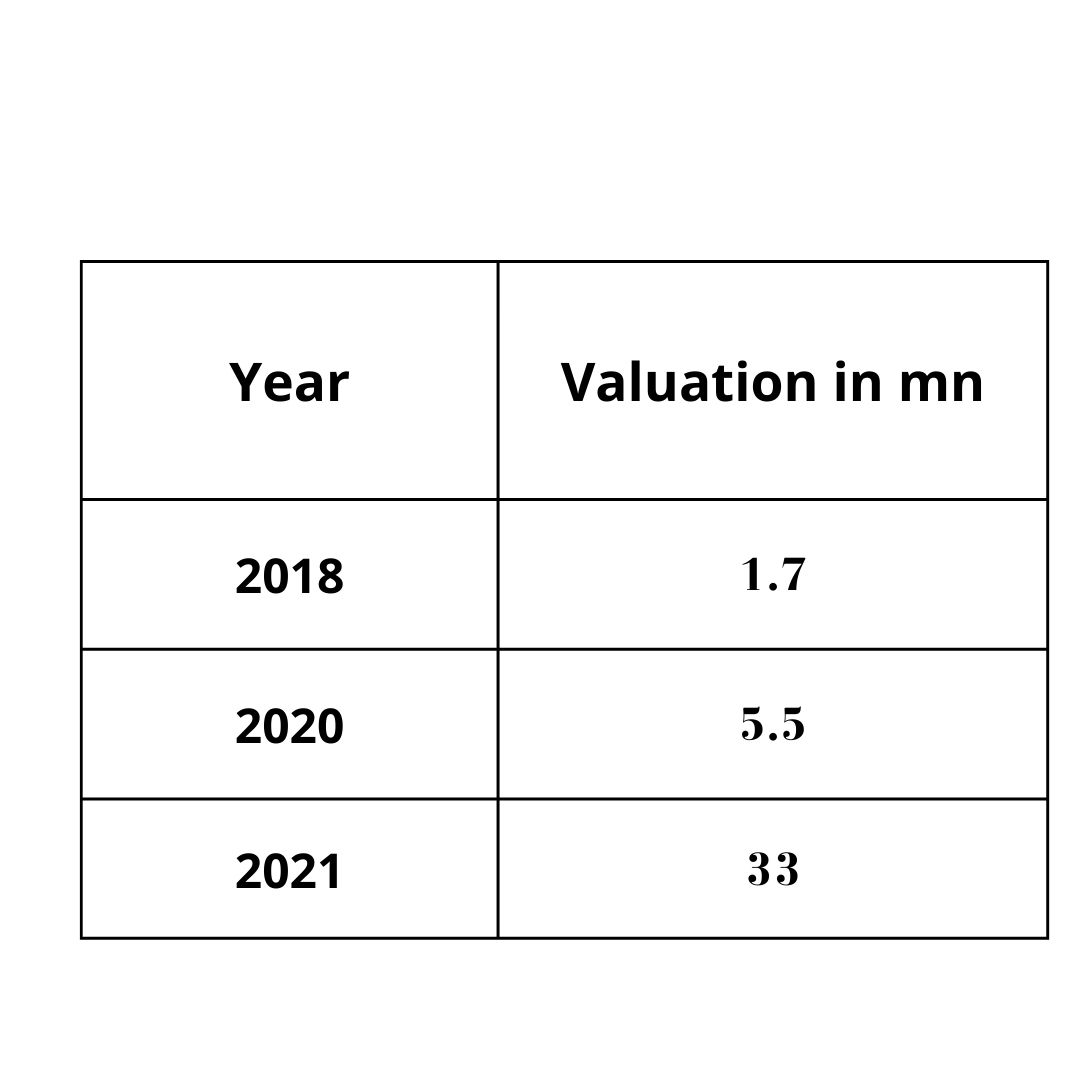

Revolut is a British neobank, which provides banking services in a single application. It was founded by Nik Storonsky and Vlad Yatsenko in 2015, with the mission to make cross-border transactions easy. The company has a total user base of 18 million with a valuation of $33 billion! Revolut supports 200+ countries and 500k businesses around the world.

It's a full-fledged bank that offers services across all banking products like digital bank accounts, digital cards, seamless payment, no charge for cross-border transactions, and many others. Before getting into the products and revenues, let’s have a look at their journey.

Revolut Timeline from 2015-2020

- 2015- Revolut launched money transfers and exchanges in the UK

- 2016- Raised $15 mn, reached 10,000 personal customers

- 2017- Raised $ 66 mn, launched Revolut Business, Revolut Premium, Crypto Trading in EEA

- 2018- Raised $250 mn, granted a banking license by Bank of Lithuania, launched Revolut metal premium service

- 2019- First expansion outside the UK, where? Australia and Singapore, launched trading, donation partners, customers base grew to 10 mn

- 2020- Raised $ 580 mn, further expansion in Japan, Lithuania, Poland, and the USA, customers- 14.5 mn, merchants in 13 countries

- Today, they have built an ‘all-in-one’ super-app. Customers all around the world use dozens of Revolut’s innovative products every day to make more than 150 million transactions a month.

How is Revolut different from Traditional Banks

1. Electronic Institution: They call themselves ‘an electronic money institution.’ They don’t handle cash or cheques through offline branches, they handle every financial matter digitally.

‘We offer many of the same features as a traditional business bank account. But, our status as an electronic money institution has allowed us to focus on creating a product that is a great option for contemporary businesses. We’re a business account that moves at the same speed as your growing business.’

2. Revolut Business: Revolut Business offers different features of Business APIs, Subscriptions, and Partner apps that provide an overall better experience to their customers.

3. Features: organizing subscriptions, junior banking, and on-demand pay are more appealing to the customers than traditional banks offer

Products that stand out

Two of their products which stand out among customers really well are-

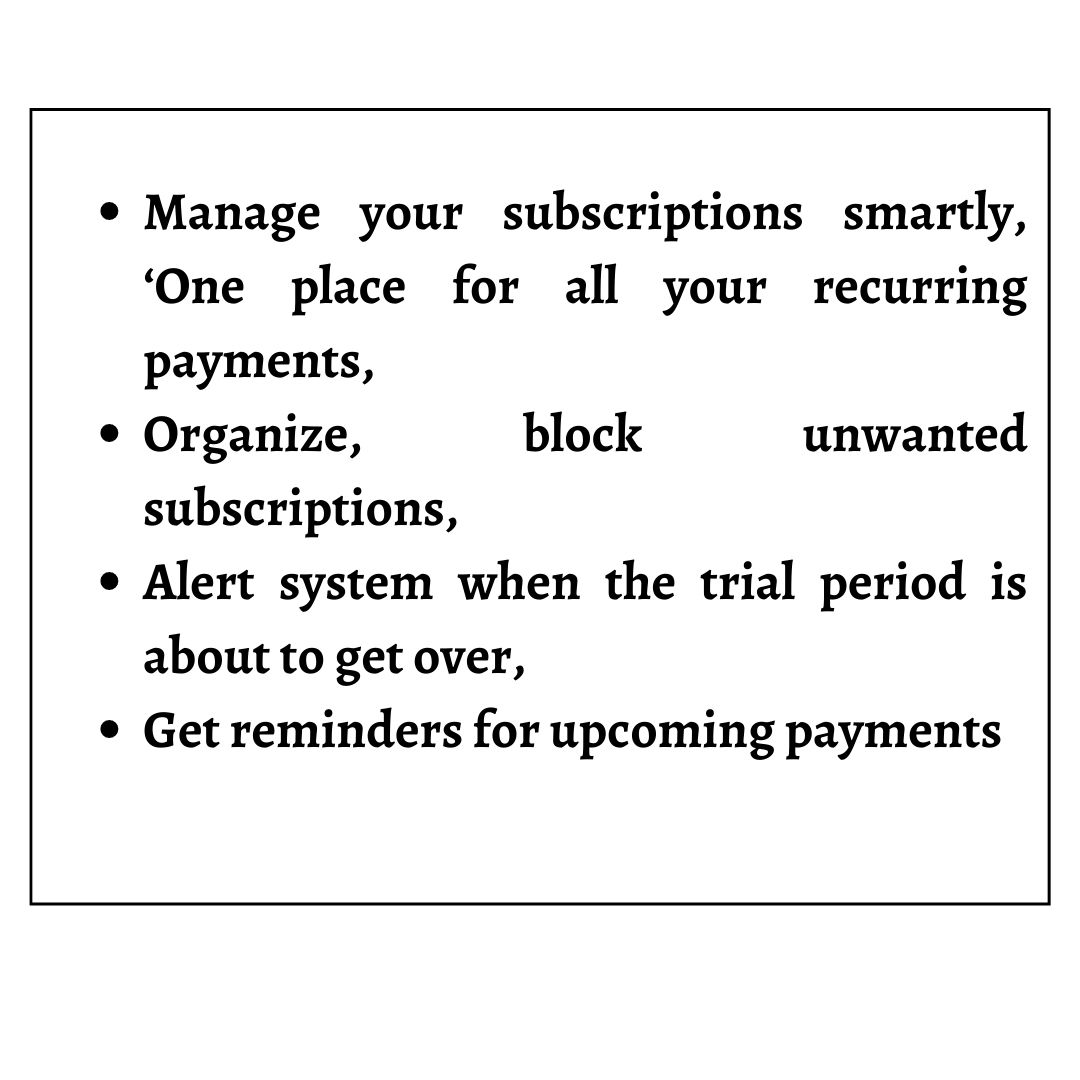

1. Organize subscription: Track your every subscription, and see your recurring payments in one place. You can link your payments to the Revolut Card, mark the payments and take control. One can get rid of unwanted subscriptions by blocking outgoing payments with a single tap, at any time of the month.

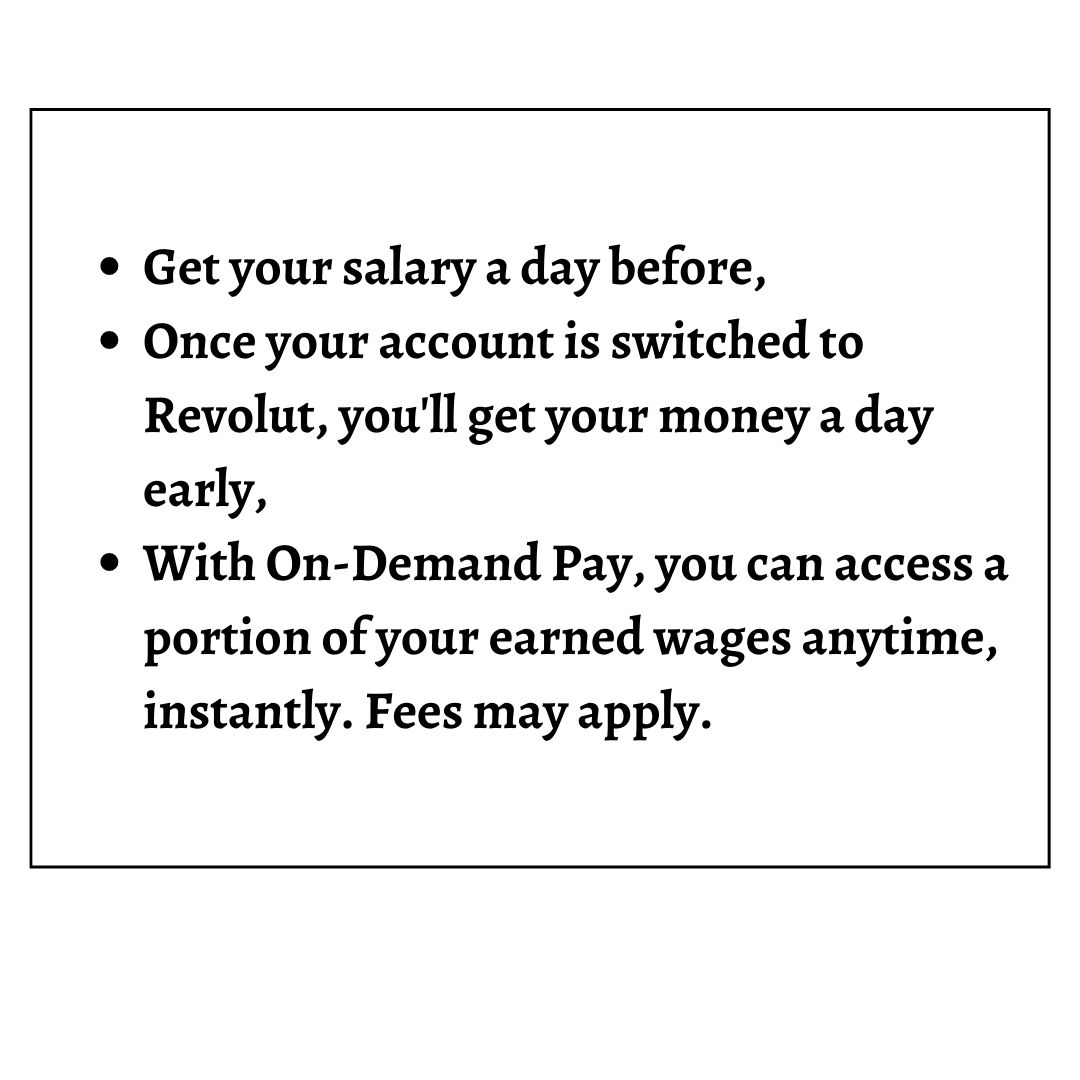

2. Early salary: After switching your normal account to Revolut, one can get their salary a day earlier than everyone else. Apart from this, the on-demand payment feature is an exciting one, where one can withdraw up to 50% of what they’ve earned whenever they need it. For just a small fee, it’ll be in your account right away.

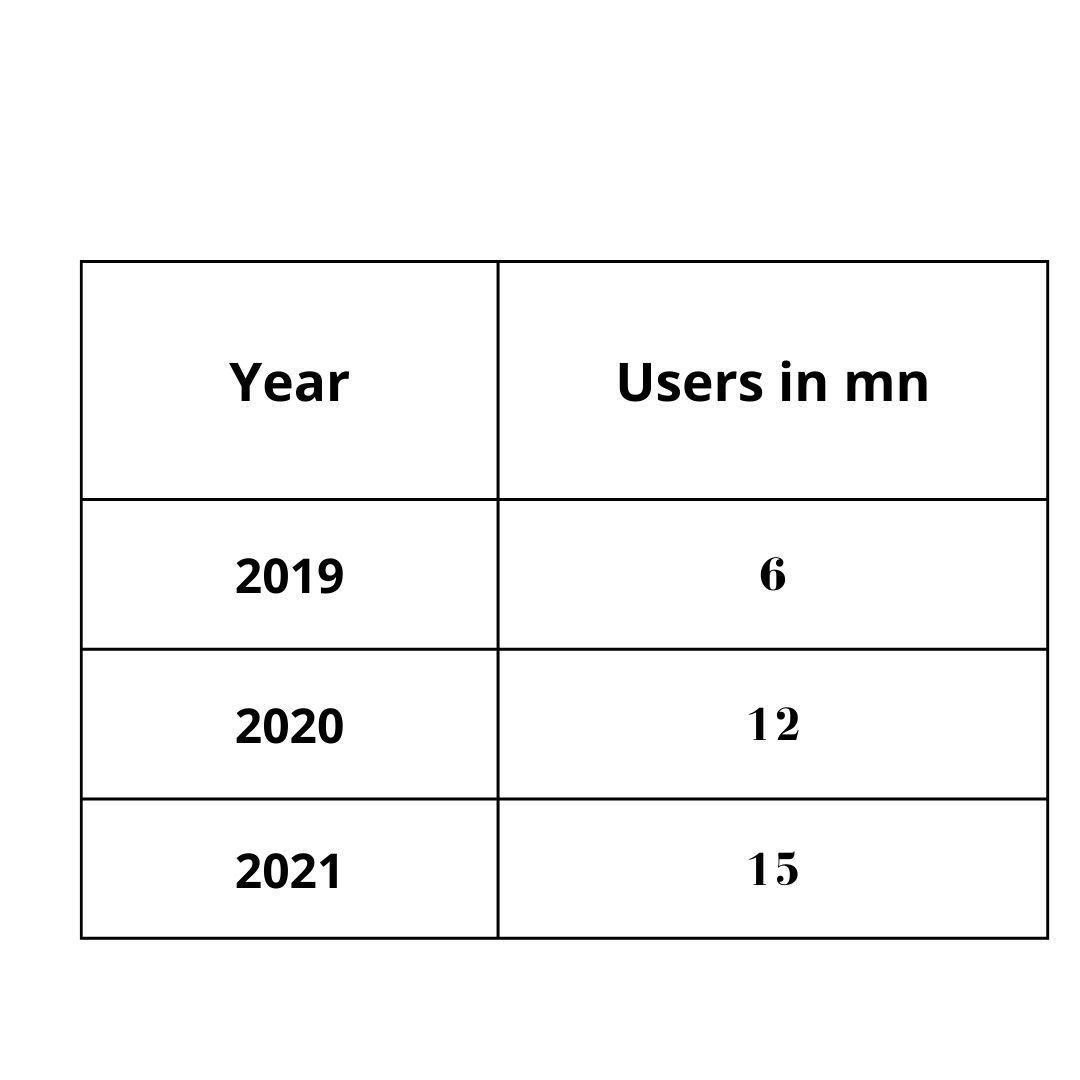

Users are increasing every year

Revolut helps customers improve their financial health, gives them more control over their money, and connects people seamlessly across the world. From 2019 to 2021-

(Source)

(Source)

- Daily active users in 2020 were 1.1 mn

- Revolute transactions in 2021- 150 mn/month

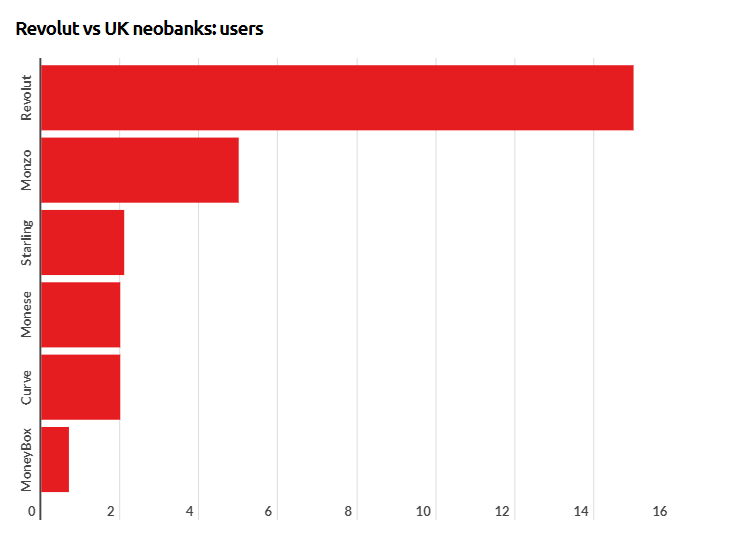

The number of Revolut users is much higher than its competitors!

(Source)

(Source)

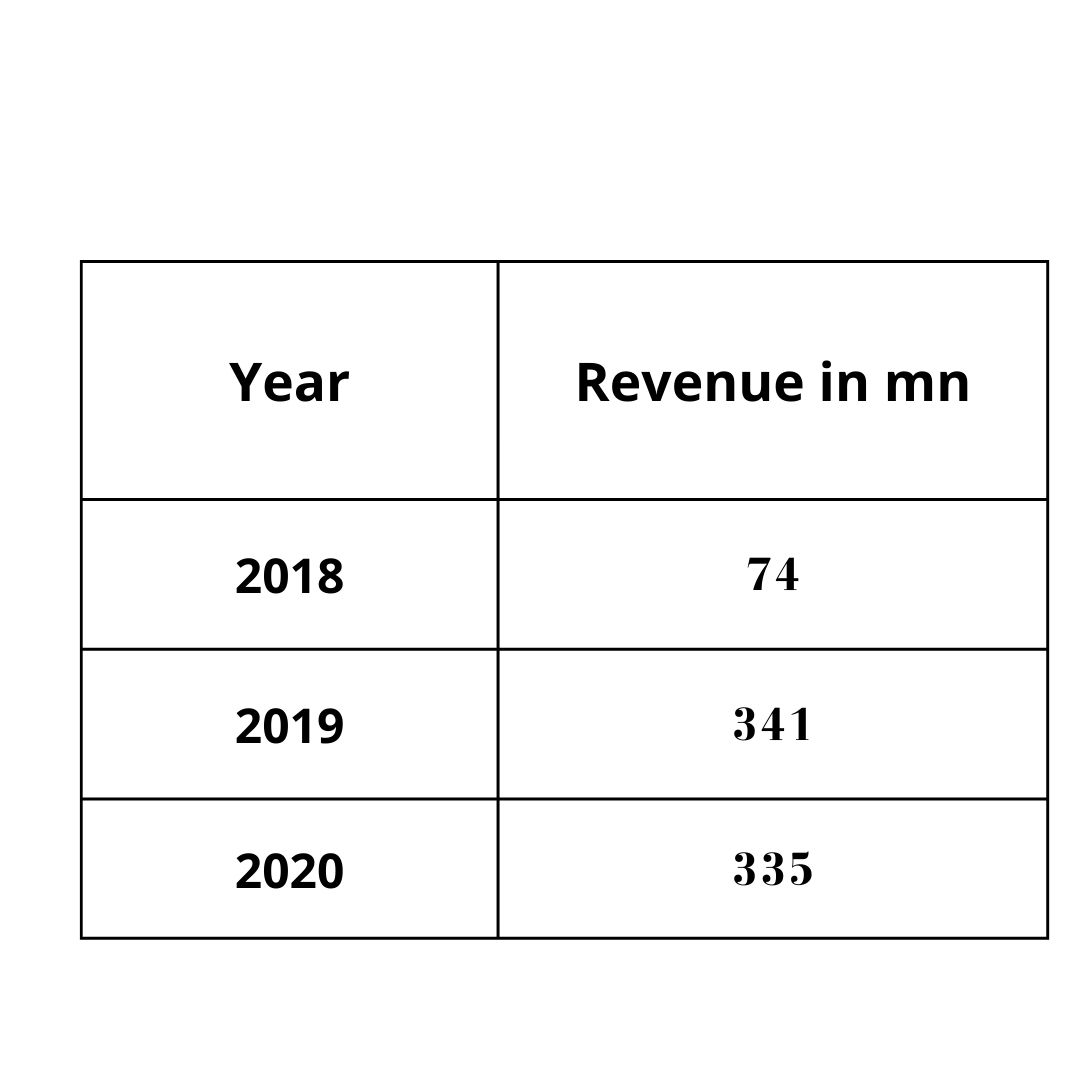

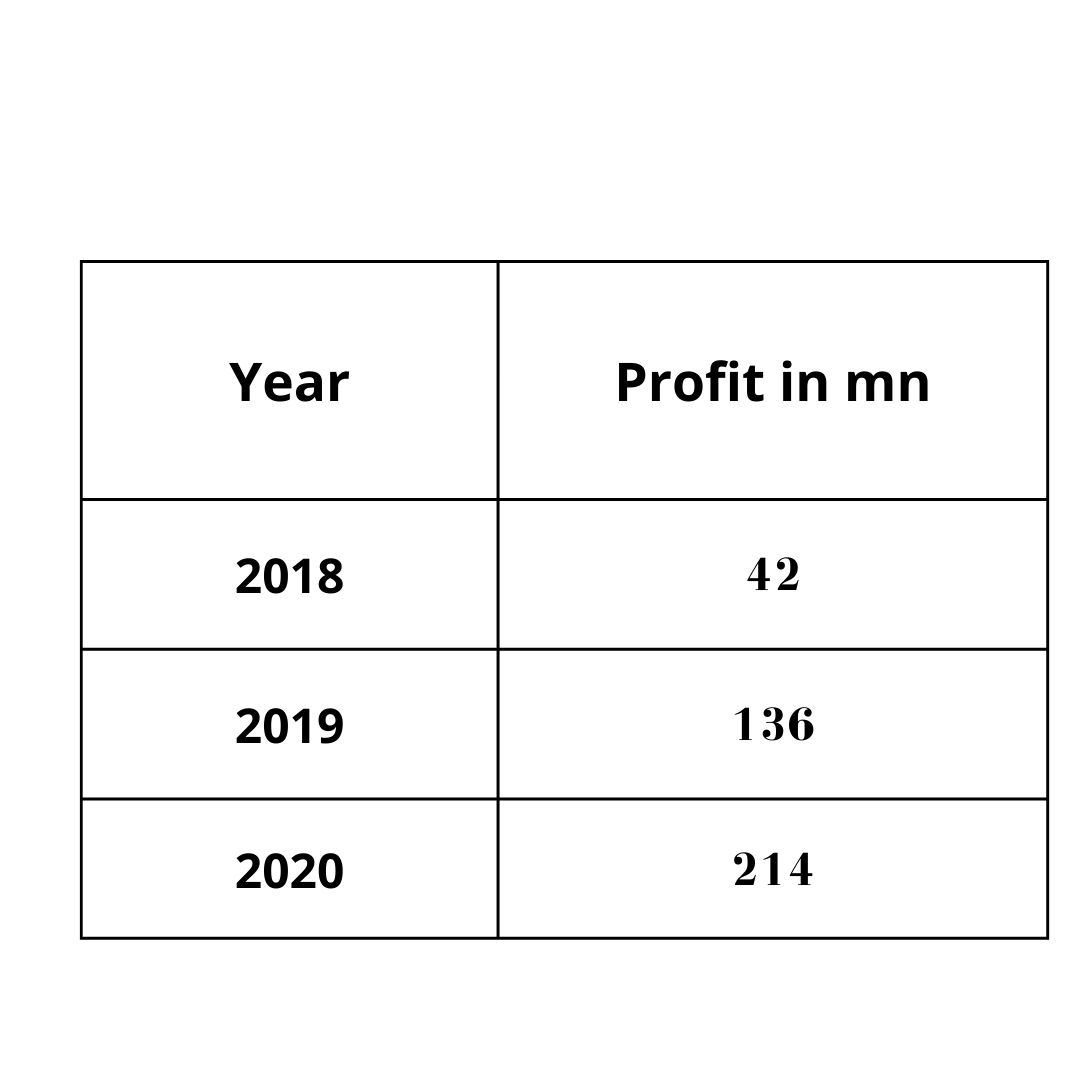

REVenue Growth

From 2018-2020, we can see tremendous growth in their Revenue

(Source)

(Source)

- Gross margins improved to 49% in 2020 from 25% in 2019.

- Almost 88% of the revenue is coming from the UK. Imagine the growth after global expansion.

- These revenue growths happened just in the span of five years. This means, it’s not about how long you’re in the business, it’s about how much you are able to plan your products strategically.

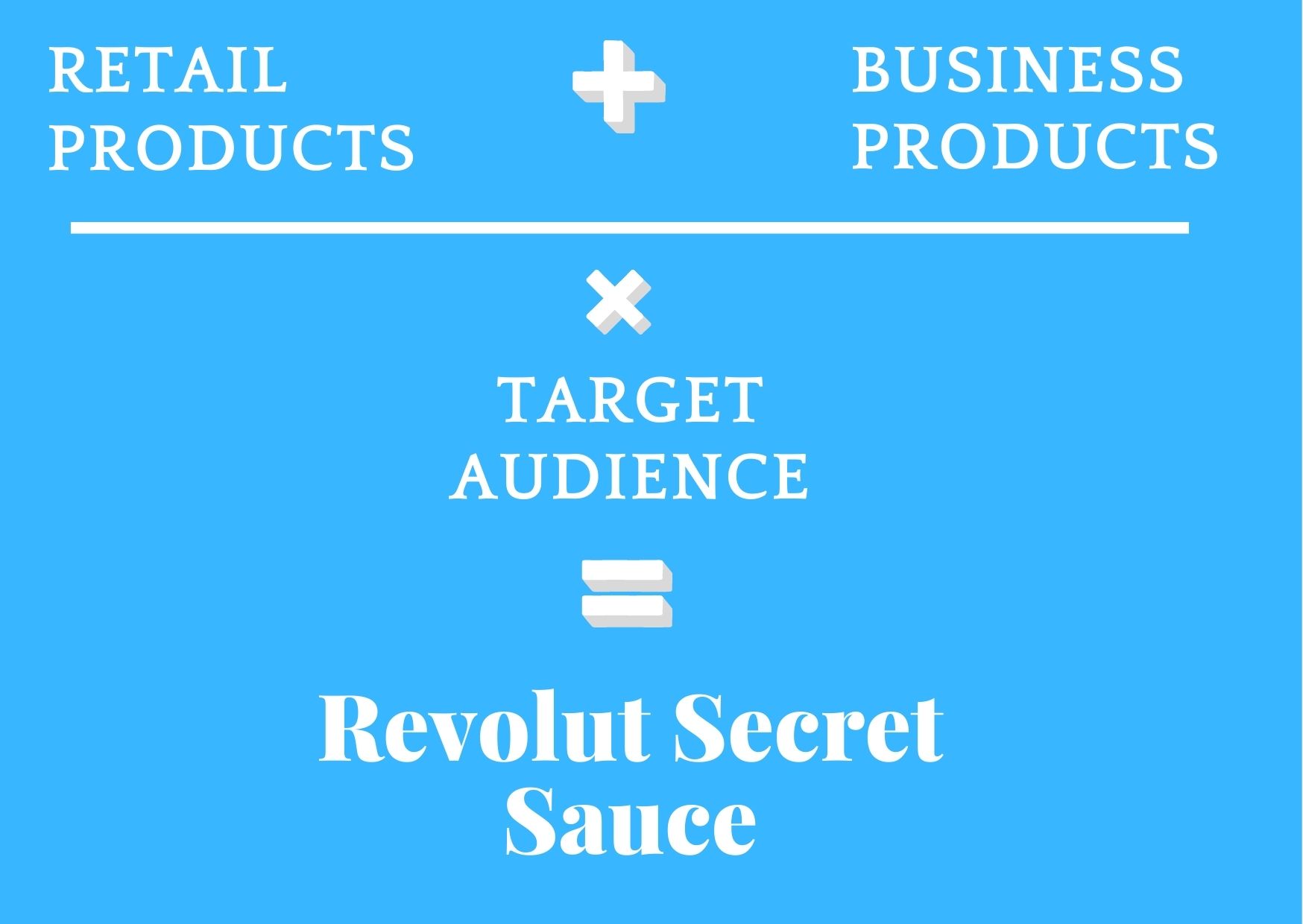

Revolut Super-app Way

“The goal with our financial super-app is to offer one place for all things money to all customers everywhere. The Revolut ecosystem with our Retail and Business accounts includes fully integrated products with superior user experience, for all our customers’ financial needs in life.”

Revolut Everyday Products

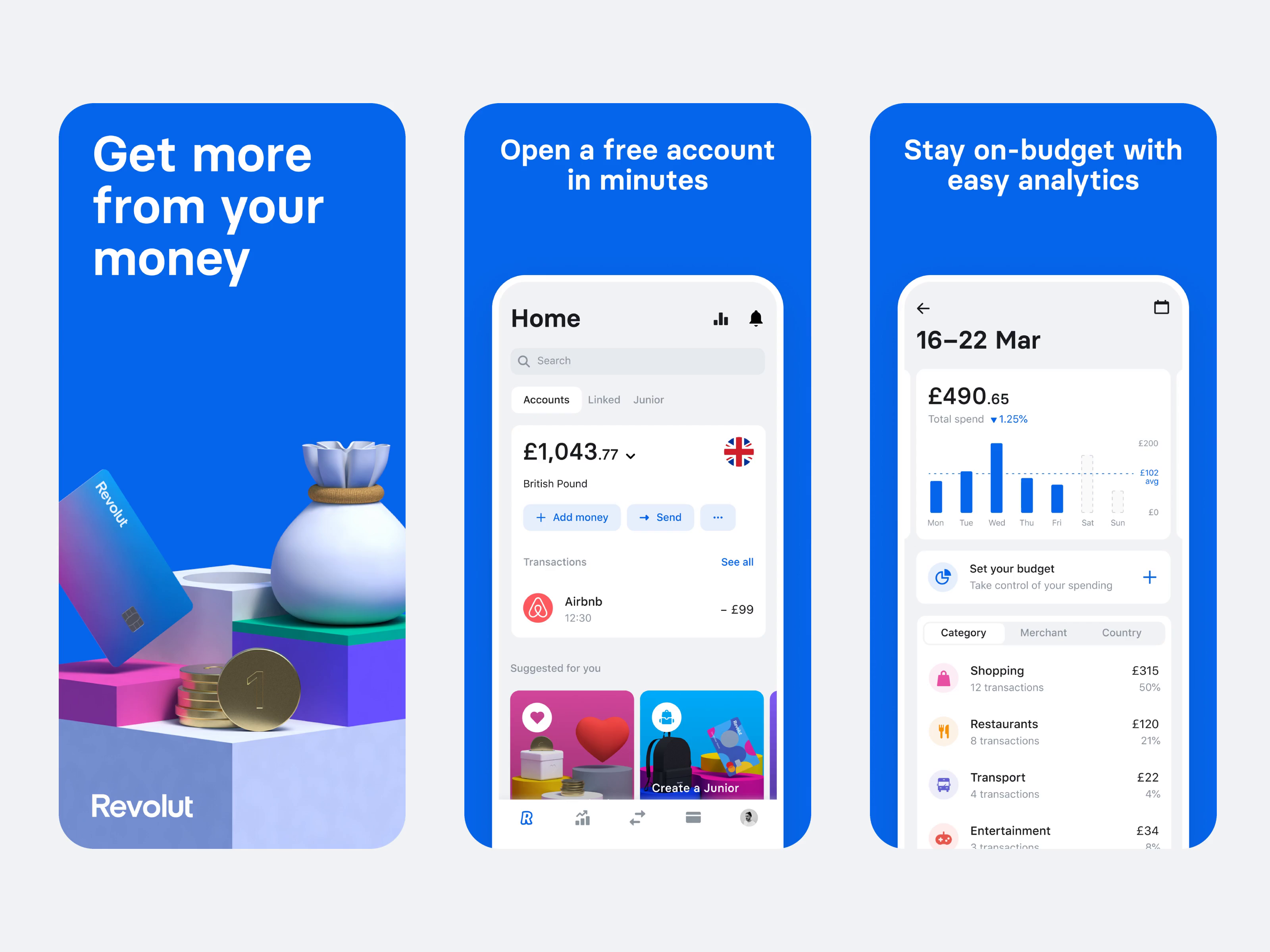

Within one application, Revolut has almost everything that a customer could imagine. It has created a whole ecosystem for its customers that wouldn't let them go anywhere. Here are some of the main features of the application-

1. Switch your current bank account to Revolut

2. Target Gen Z

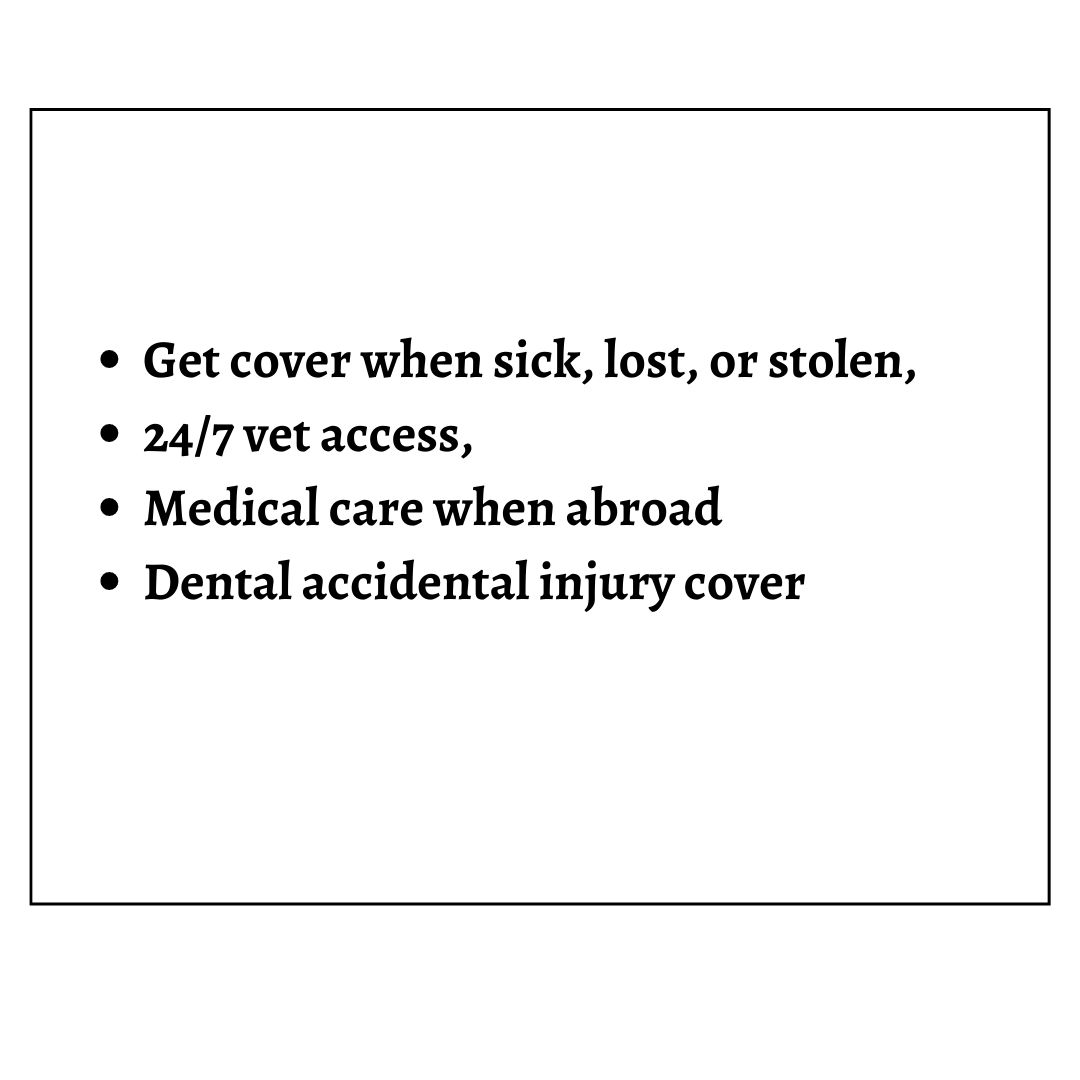

3. Product for Pets!

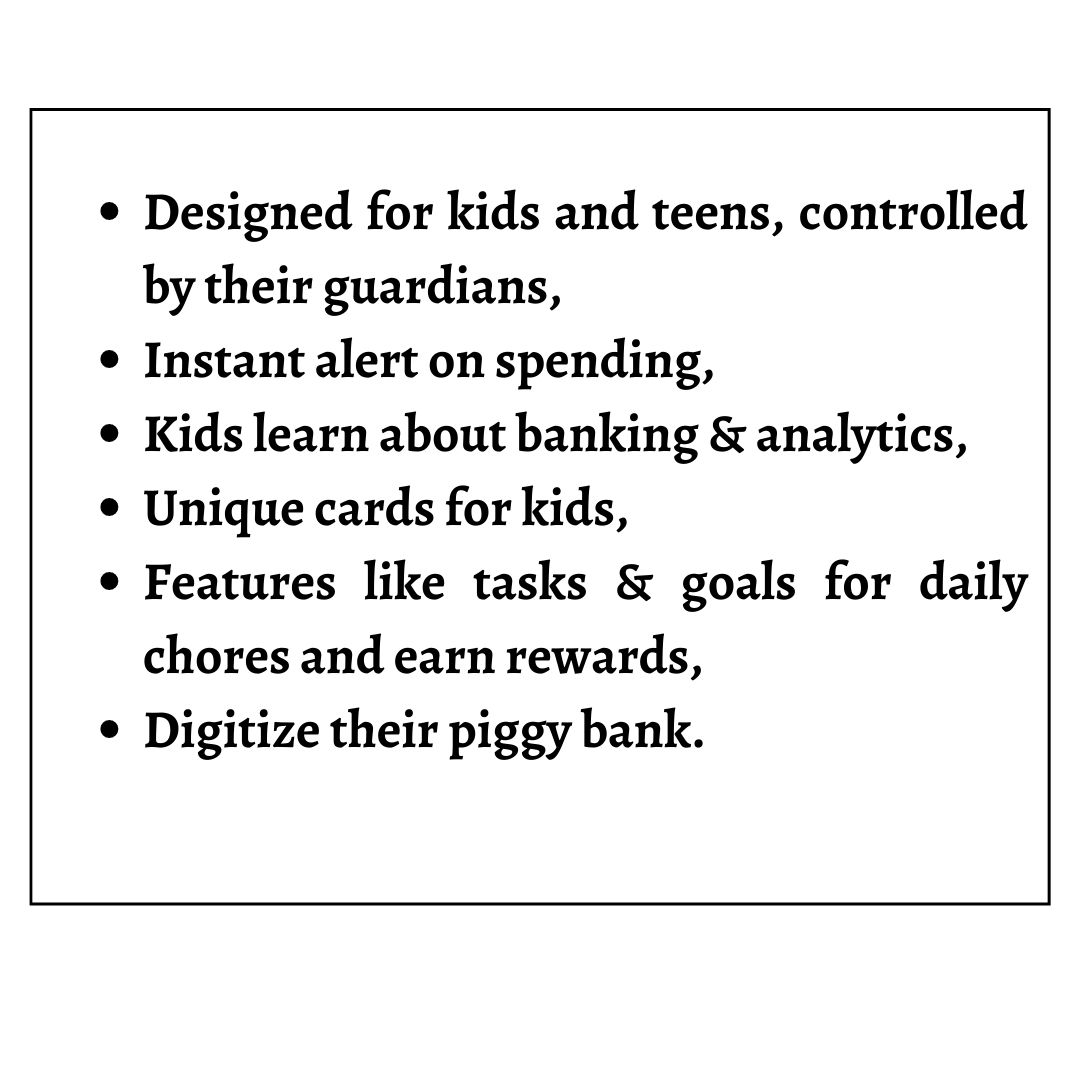

4. Follow the trend, Junior Banking

That’s not enough! Revolut is continuously growing and exploring its services across the globe.

Link your accounts in one place and get peace of mind

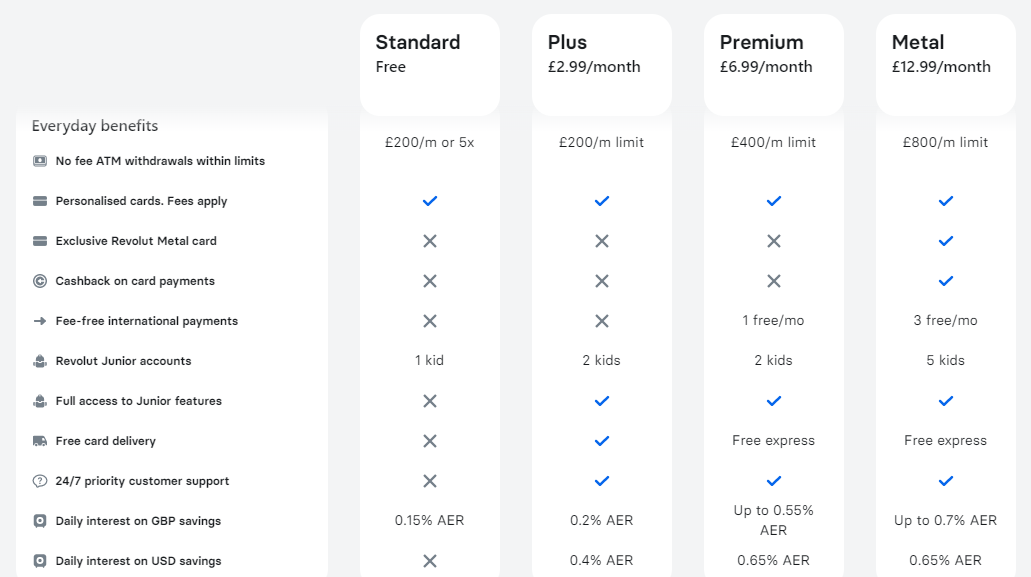

Revolut People’s Subscription

There are three main subscription plans in Revolut which are as follows:

Revolut Business Products

Revolut has not confined itself to lifestyle banking. They have also expanded their ecosystem into the world of business, where SMBs and freelancers can avail of various services related to their business in a single application. Some of these are-

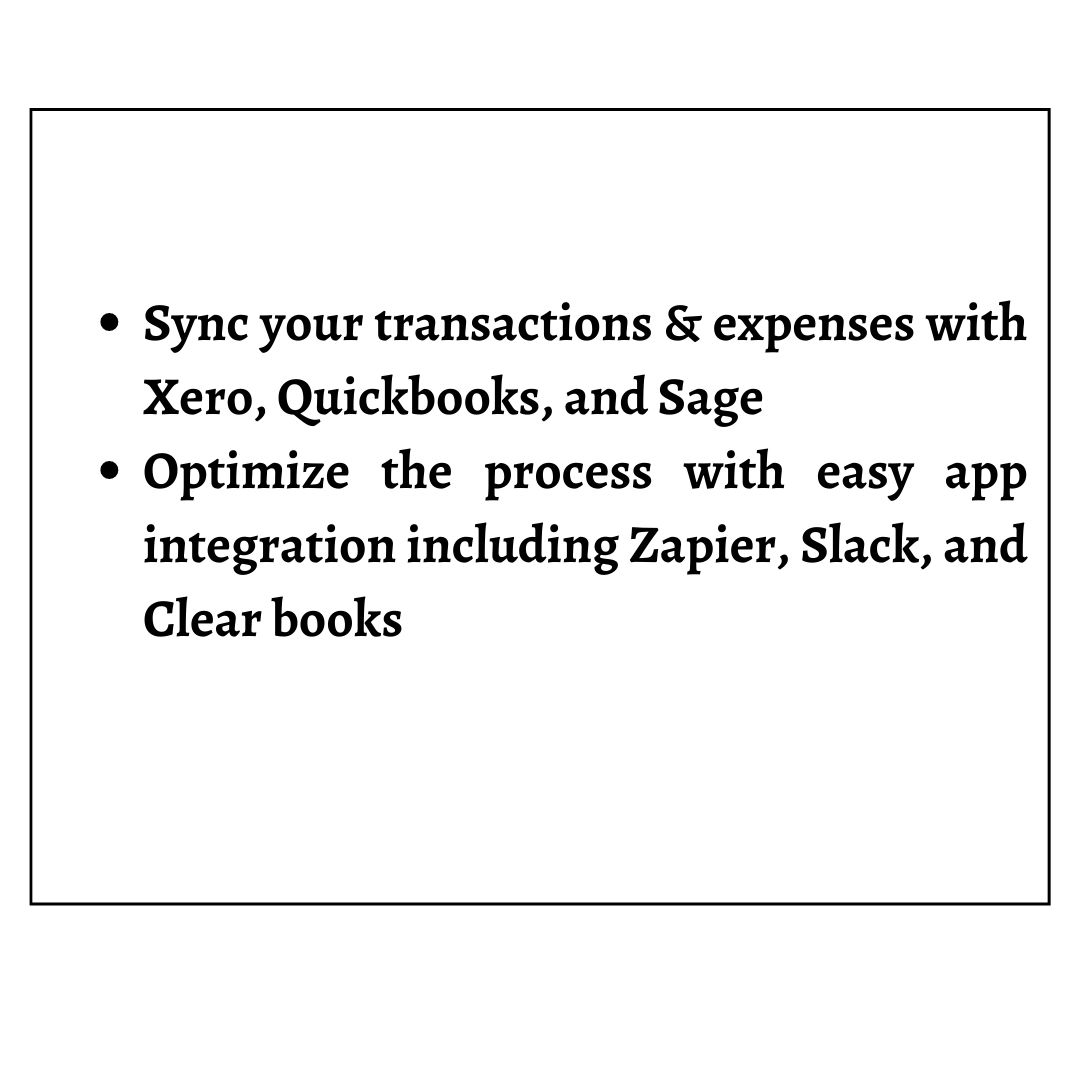

1. Partner with the apps

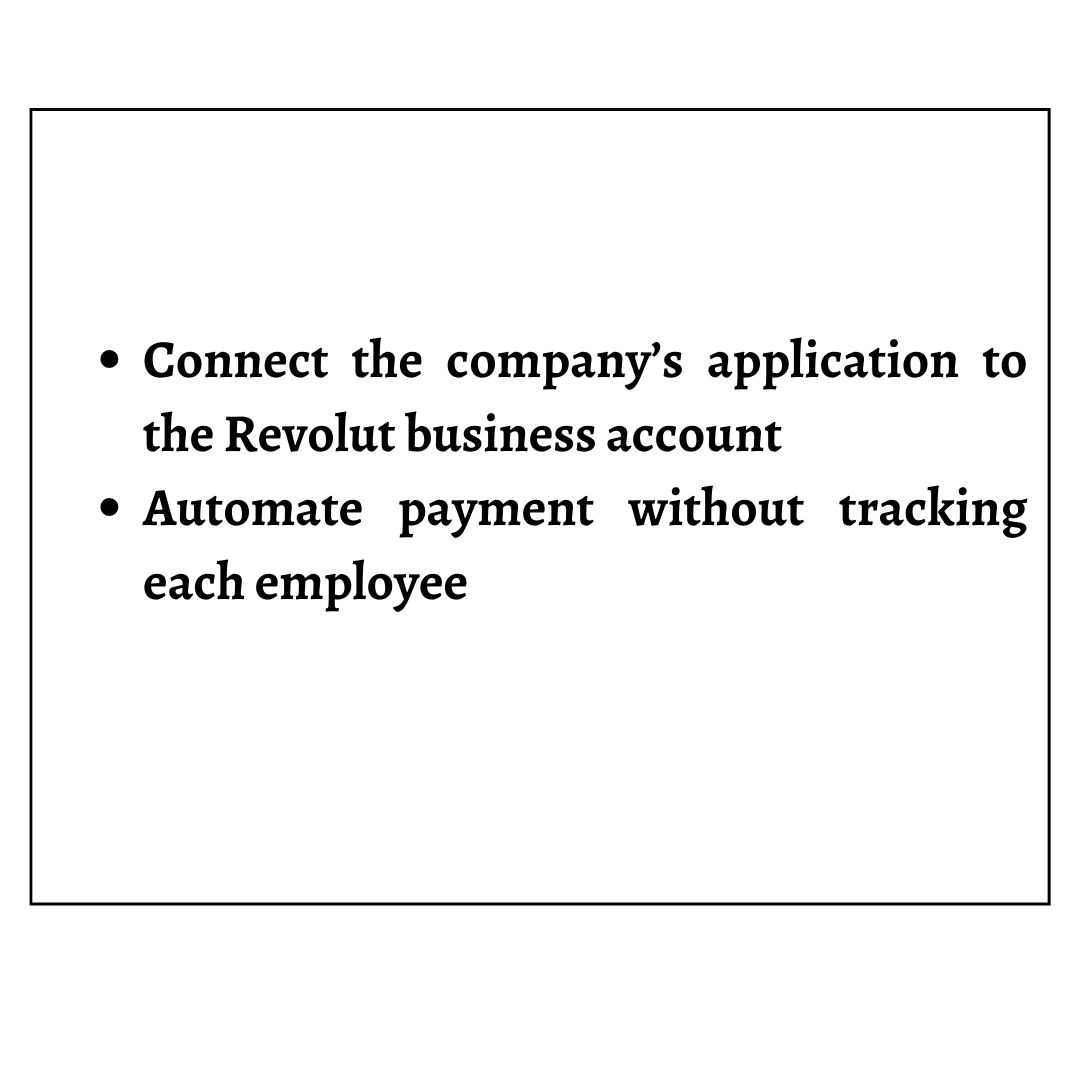

2. Integrate API

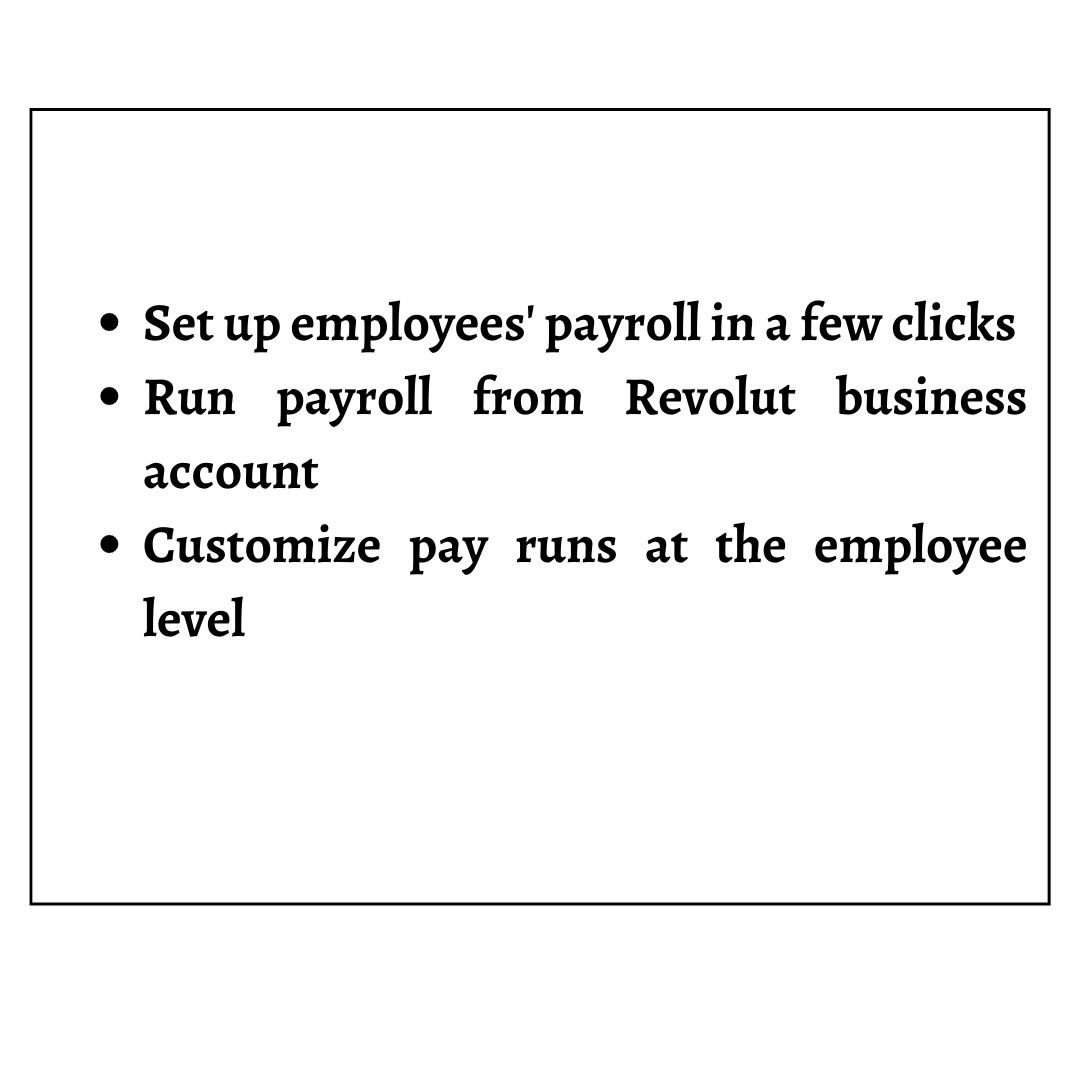

3. Ease for Employees

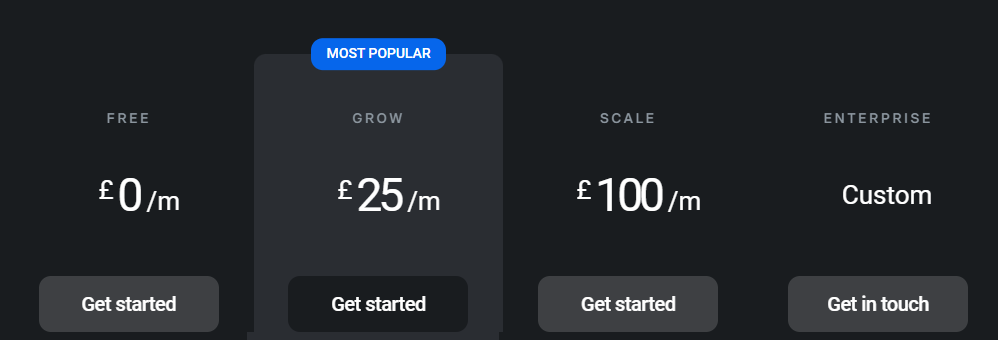

Revolut Business Subscription

Nikolay Storonsky, CEO “We focused on activities and investment that followed our goal of creating a financial super-app, developing and releasing 24 new products to make customers’ lives easier and drive daily use.”

Revolut Engagement Strategy

Revolut NPS score is 58 with a 4.7 Google rating

Why? Revolut invested its time and money in the products, rather than marketing. This is why the daily active users in 2020 were 1.1 mn. Revolut glued its customers in by using a reward system, gamification, incentivized user referrals, and whatnot. Studies show that 92% of people trust referrals from friends and family. Referrals are achieved by creating loyal customers, which are formed by a fun and satisfying app that keeps users engaged!

The app becomes more useful for the people who use it more often. Features that give purpose to the users to use the application aka ‘intrinsic motivation’.

How? By introducing a personalized interface, customer loyalty programs, rewards & gifts for family friends, and so many other features that keep its customers engaged with the app.

*We monitor their feedback using metrics such as net promoter score (“NPS”) and Customer Satisfaction reviews and we analyze in detail how customers use our product so that we can prioritize what they value most and make our products, marketing, and communications relevant and valuable to them. *

Recently in Revolut

- Revolut is planning to launch a ‘buy now, pay later’ service that will apply to both online and offline shopping. This would foster engagement in the application. “Instead of paying upfront everything, you pay a third and then in two weeks’ time we charge you a third and then another third,” Revolut’s chief executive Nikolay Storonsky told the publication.

- Revolut has launched its stock trading feature in Australia. Australians can now invest as little as $1 in popular US stocks. It also offers a ‘social trading’ feature that allows users to share and observe others trading activities.

- Revolut has acquired a Forex License holder, Arvog Forex Private Limited in India. The acquisition will strengthen Revolut’s foundation in India and accelerate its plans to offer a best-in-class remittance service and multi-currency accounts to Indian customers.

- Revolut junior brought Google pay to its junior customers present across the UK and EEA. An easy way to carry, who would be able to make quick and hassle-free payments from their Junior account using their smartphone.

We got a clear answer from the information above, Super-App is the way to survive in this competition. By 2026, 91% of the global population will have smartphones. Meaning approximately 91% of the world’s population will be dependent on smartphones for their everyday activities. What a great opportunity to build a super-app.

Conclusion

But we can also see that banks are nowhere in the competition. Why? Because banks don’t have products, partnerships, and technologies in their application. They have a good customer base, they have customer trust but they aren’t up to date with the trend i.e., Super-app.

So, how can banks compete with others? One liner answer would be, follow the trend. To give you a brief idea about what banks can do, here are a few examples-

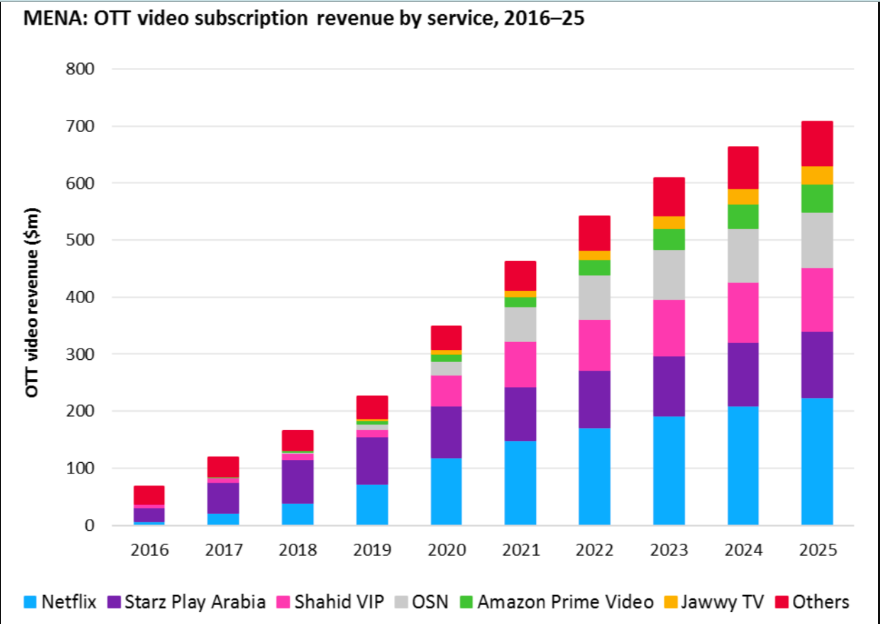

1. Subscription- Paid OTT video subscriptions rose by nearly 77% year-on-year (YoY) in MENA last year, reaching just over six million at the end of 2020. Big companies are investing time and resources into customer-centric and data-driven growth, creating $1.7 trillion to $3 trillion opportunities across industries. A subscription is a great way to go!

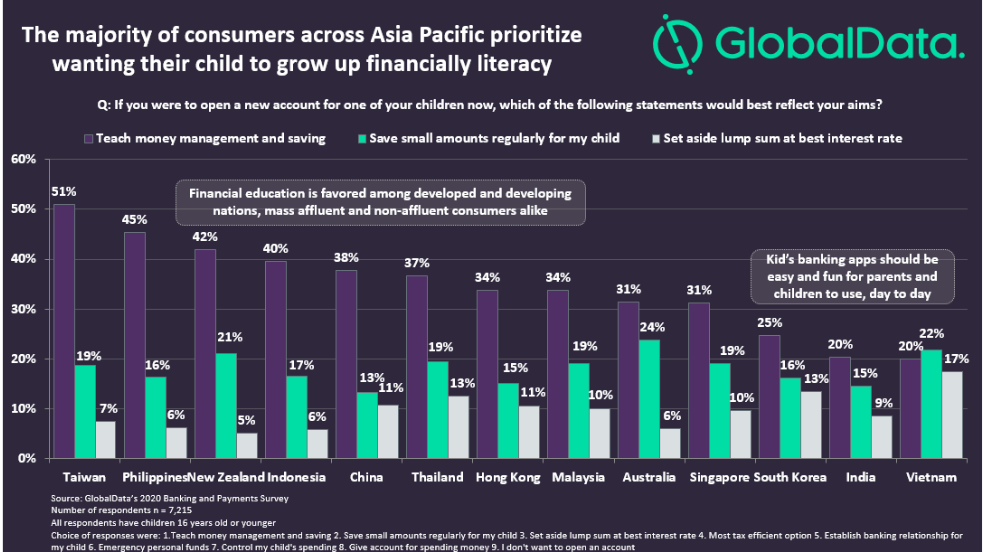

2. Junior Banking- Banks can fill this gap, as parents consider them well-suited to offer financial content, according to GlobalData’s 2020 Banking and Payment survey. By offering easy-to-use, educational products for children, banks can establish themselves as "fountains of knowledge" and forge deeper connections with both parents and children, seamlessly expanding their customer base.

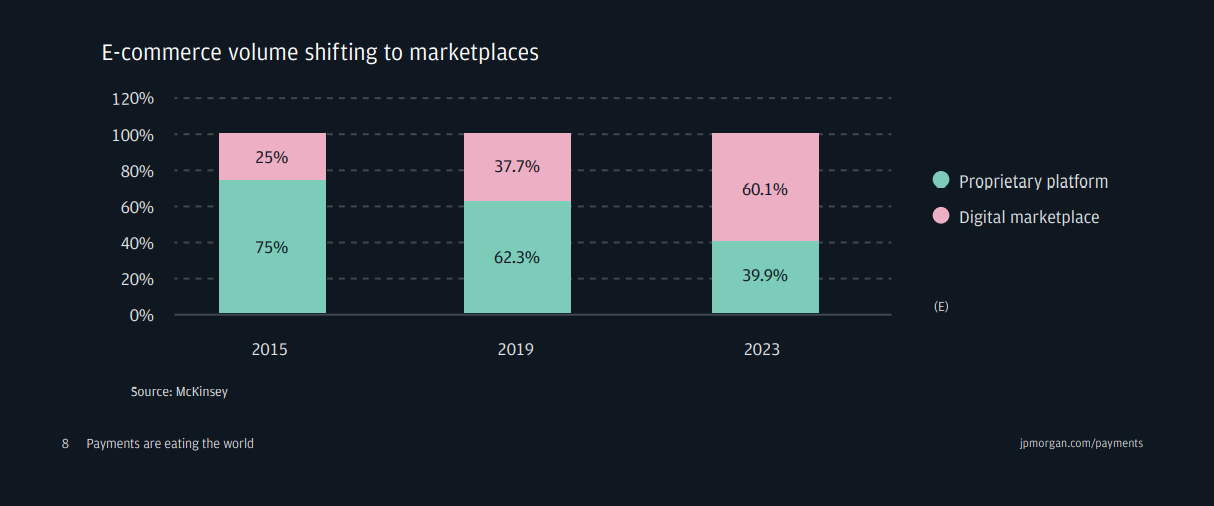

3. Partnerships with merchants- According to Boston Consulting Group, $5 trillion in annual global retail sales shifted from offline to online due to the pandemic, and the shift is likely here to stay. Before the pandemic, e-commerce businesses were already spreading, and after the pandemic, the shift is speeding up at its pace. It’s high time for banks to catch-up.

And there are other services as well that banks can incorporate into their application. For that, companies like Nuclei help banks to come up to the surface and build their own super-app.

One app, all things money…

If you want to know more about how banks can come ahead of everyone, drop us an email at research@gonuclei.com and we will schedule a session for you.