NuBank is a Brazilian neobank and is one of the largest fintech companies in Latin America. It offers services like digital bank accounts, credit, debit cards, insurance, and much more to its customers, which is why the valuation of the company has gone up to $41.5 billion in 2021! NuBank was founded by David Velez in 2013 with the main aim to provide easy, transparent, and accessible banking solutions to the people.

Nu Journey

- In 2014, NuBank launched its first product- a no-fee digital credit card

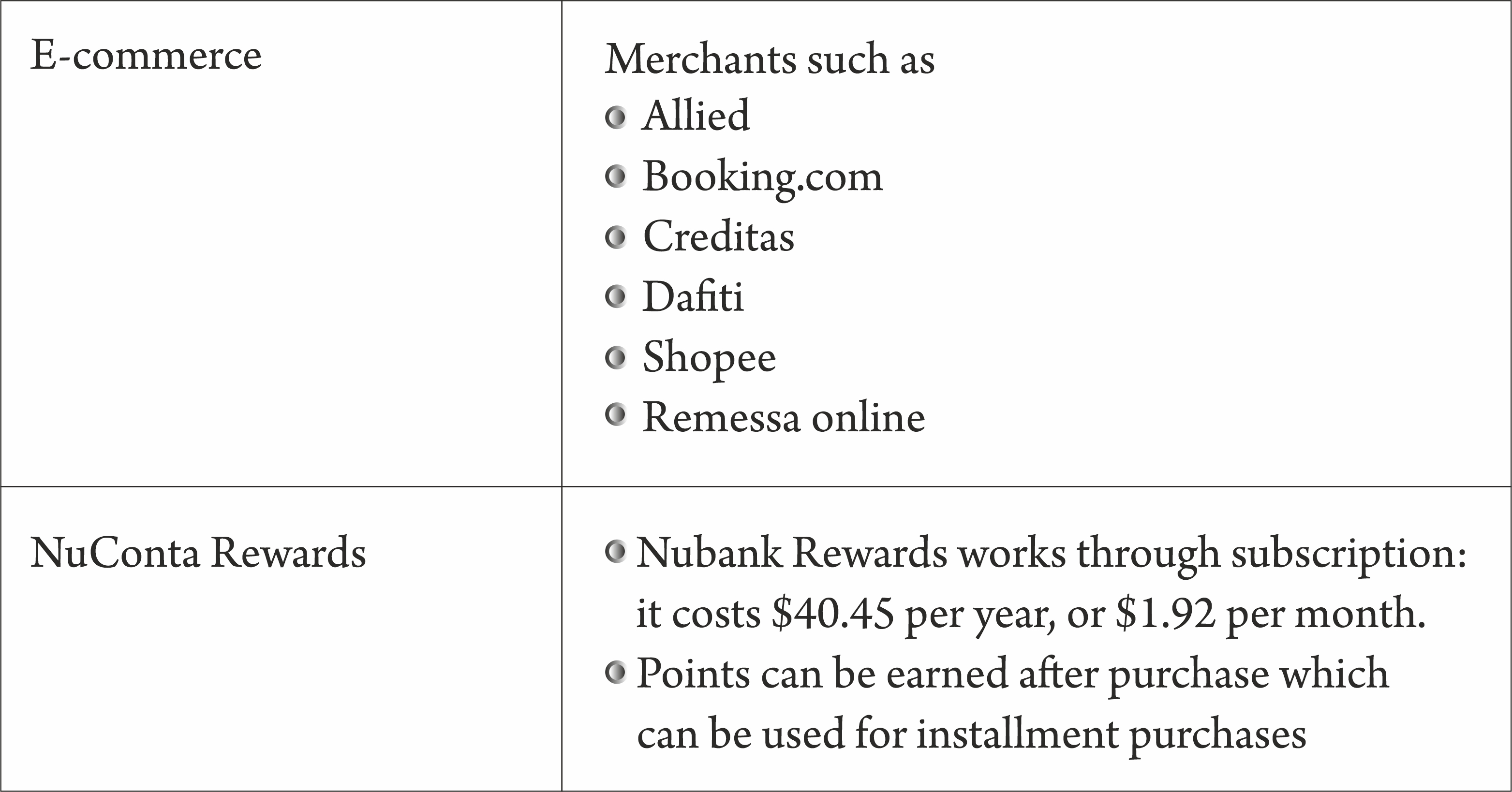

- In 2017, it came up with a loyalty program called NuConta Rewards for discounts on multiple services like travel, entertainment, shopping, etc.

- In 2020, NuBank launched its life insurance product along with Chubb, a fast, seamless, and personalized capability available to millions of customers across Brazil

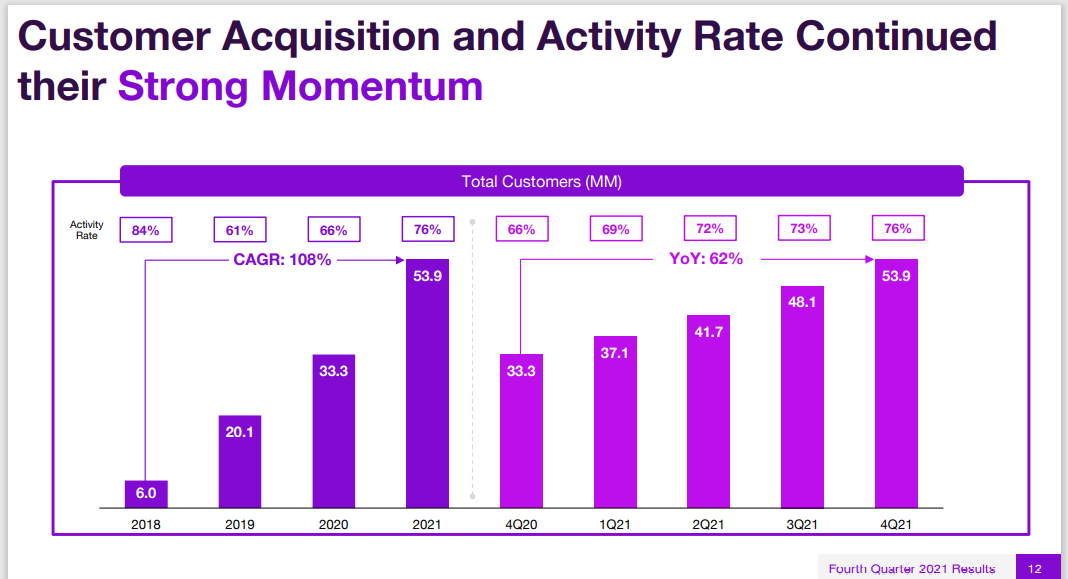

Today, it has over 53.9 million customers and offices in five geographies- Berlin, Germany, Buenos Aires, Argentina, and Mexico City, Mexico.

NuBank excelled where banks failed

NuBank thought from the customers’ perspective where they felt a change is needed. Banks were

- Charging outrageous fees- requiring clients to pay up to 15% interest on outstanding payments

- Opening a bank account or obtaining a credit card was a time-consuming process

- Customer service was not upto the mark

- Half of the population in Brazil was unbanked, despite being the world’s seventh-largest economy

NuBank solved these pain points through technolog, thus making it easy and comprehensible.

Growth via seamless customer experience

- As of March 2022, we can see the growth in NuBank,

- Revenue- $1.7 bn

- Profitability- $230 mn in 2020

- Total users- 53.9 mn

- First time Nu credit card users- 5.6 mn

- Small & Medium Enterprises (SME)- 1.4 mn (tripled in 2021)

(Source)

NuBank Active Customers’ Rate is exceptional

In terms of customer growth from 2018 to 2021, then-

(Source)

(Source)

(Source)

(Source)

Same with Revenue Growth…

An increase in customers, engagement, services and SMEs have impacted their revenue in 2021. The figures show-

(Source)

(Source)

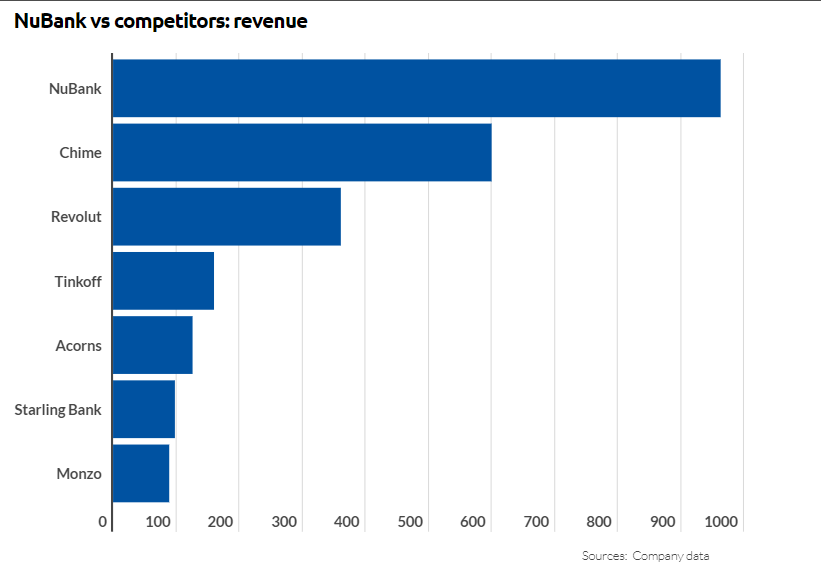

NuBank’s Revenue is much higher than its competitors!

(Source)

(Source)

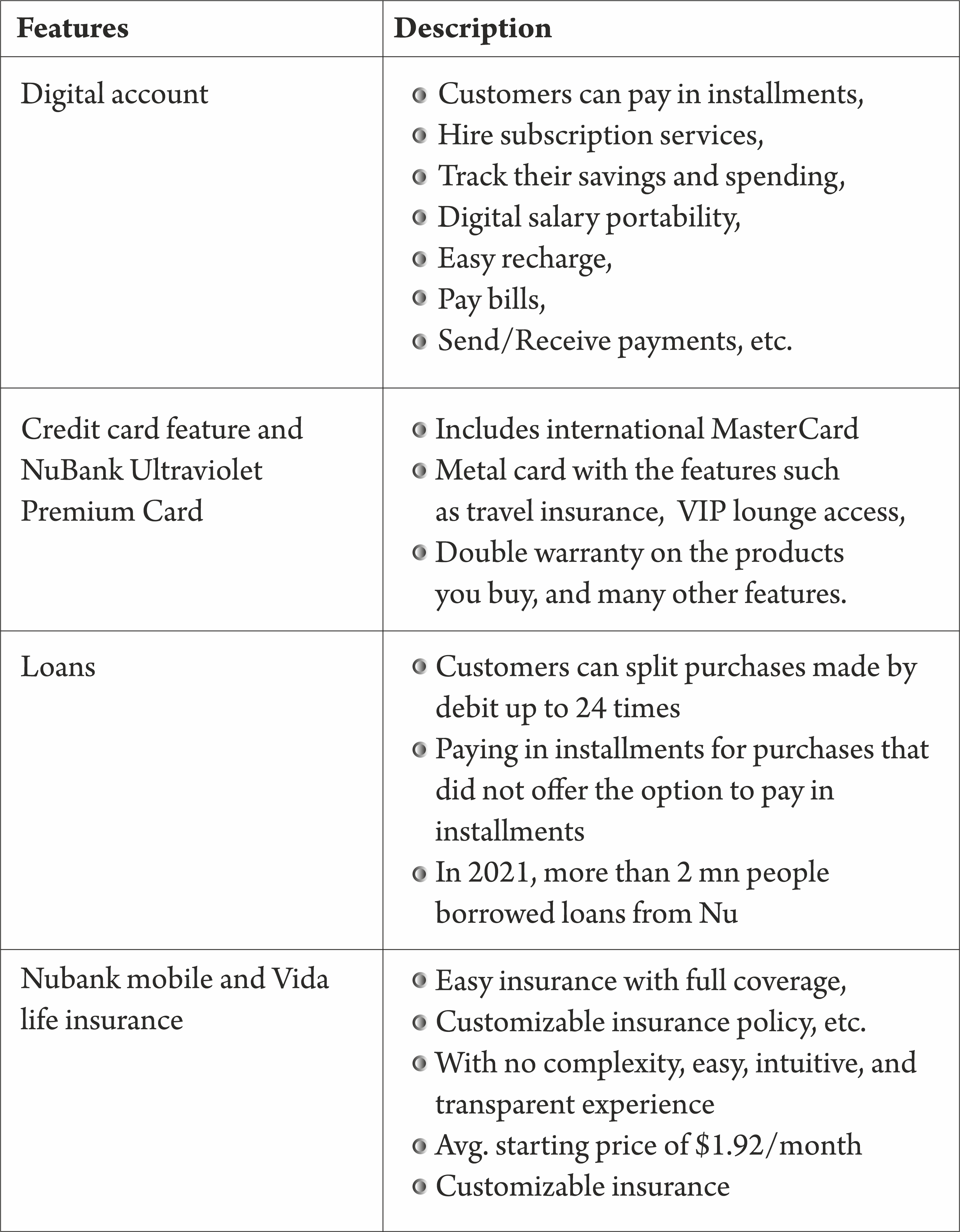

NuBank Features

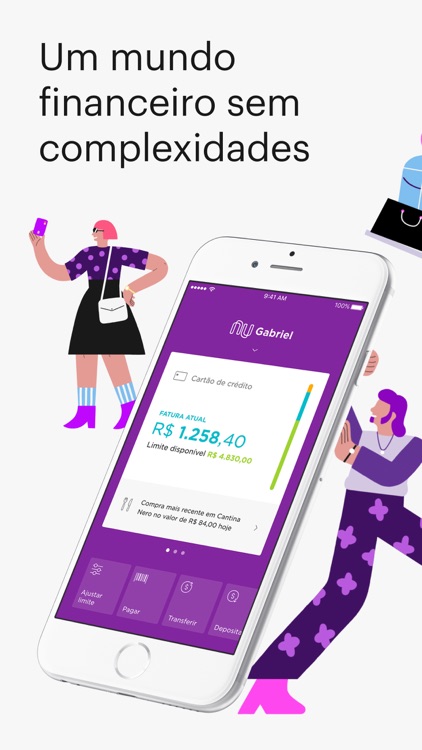

NuBank has built a super-app platform with all kinds of banking services; an all-in-one financial app for both customers and SMEs. Some of the highlights of the features are:

Some other main features are-

Translation- ‘A financial world without complexities’

Translation- ‘A financial world without complexities’

Nu-Engagement Analytics

NuBank has one of the best engagement rates in the world. It estimates that over 55% of the monthly active Nu customers for over a year have made Nu their primary banking account provider.

Here are the key stats around the engagement of the NuBank app in 2021

- Monthly visit growth- 9.51%

- The average number of products per active customer- 3-4

- Active customers using NuBank as their primary bank account- ~50%

NuBank NPS score is 90! This itself explains how well the bank is performing!

New in NuBank

- Nu launched numerous new products and features, including Marketplace, currently with over 20 partners, Apple/Google/Whatsapp Pay, UltraViolet premium card, Secured Cards, Life Insurance, and Proprietary Funds.

- NuBank has adopted new technology, Flutter, where it can create a native experience for both android and iOs users to improve mobile infrastructure and development efficiencies, such as built-in testing infrastructure for units, Integration, and end-to-end tests without the need for rendering to the screen.

“We love Flutter at Nubank. It has become 100% part of our culture when we talk about mobile development. We are also experimenting with Flutter web as it has shown many advantages when using it to improve our developer experience.” said Alexandre Freire, Director of Engineering at NuBank.

Fun Fact- The Flutter community has grown exponentially in the last 3 years, even more than any other similar cross-platform solution.

- Nubank and Duolingo Recently, NuBank has announced its partnership with Duolingo, a well-known education platform, where Nu customers can get access to Duolingo plus subscription till May 30, 2022. Duolingo plus version has some additional features other than learnings. These include unlimited lives, extra levels in lessons, language progress, and mastery tests – and no ads.

Big Question!

Are they taking away the banks' business? YES- Simply because they have so many things on their platter. You name it, they have it. Neobanks like NuBank focus on simplifying the banking experience for their customers by using technology as their solution, hence creating ‘A financial world without complexities’.

BUT- Banks also compete with them! They just need an action plan to be ahead of everyone in the game. How exactly?

- Incorporating technologies like Flutter

- Products like Merchant marketplace, Subscription

- Provide expenses’ visibility to the customers

- Seamless payments within their banking application

And so many more things that they can do.

Want to know more about how banks can conquer with technology? Drop us an email at research@gonuclei.com and we will schedule a session for you.

NuBank presentations. References 1, 2,