In the ever-evolving landscape of banking, one critical area often overlooked is the untapped potential within customer segments. Closer scrutiny reveals the absence of precise segmentation in offerings, particularly in the realm of credit cards. The homogeneous nature of existing credit card offerings has led to a significant gap in meeting the distinctive lifestyle needs of ultra-high-net-worth individuals (UHNWIs).

UHNWIs, characterized by their sophisticated choices, are increasingly seeking exclusivity beyond the conventional benefits offered by mainstream credit cards. Their discerning needs present an exceptional opportunity for strategic segmentation within the credit card domain.

Digging deeper into this topic, we spoke to several ultra-high-net-worth individuals (UHNWIs) to understand their preferences for credit card privileges.

Most of them shared common sentiments regardless of the bank which provided the card,

- Privileges offered to them by most banks were not premium enough

- Many were unredeemed as they were not relevant to them

Let’s take a deeper look at the privileges associated with premium credit cards and how their target segment views them.

Current State of Credit Card Offerings:

As per the UHNWIs we spoke to, most Indian banks have a ceiling in defining the premium segment. Except for a couple of banks, premium customer base is defined by those with an annual income of INR 25-36L pa, or a TRV of INR 15-25L. Those with TRVs of INR 1Cr - INR 10Cr, a segment that has grown about 40% in the last 5 years, find themselves in the same cohort as the mass affluent and feel underserved.

75-80% of the offerings across the credit cards of most banks are similar. Very few extend beyond the packages of network partners to personalize offerings for their customers.

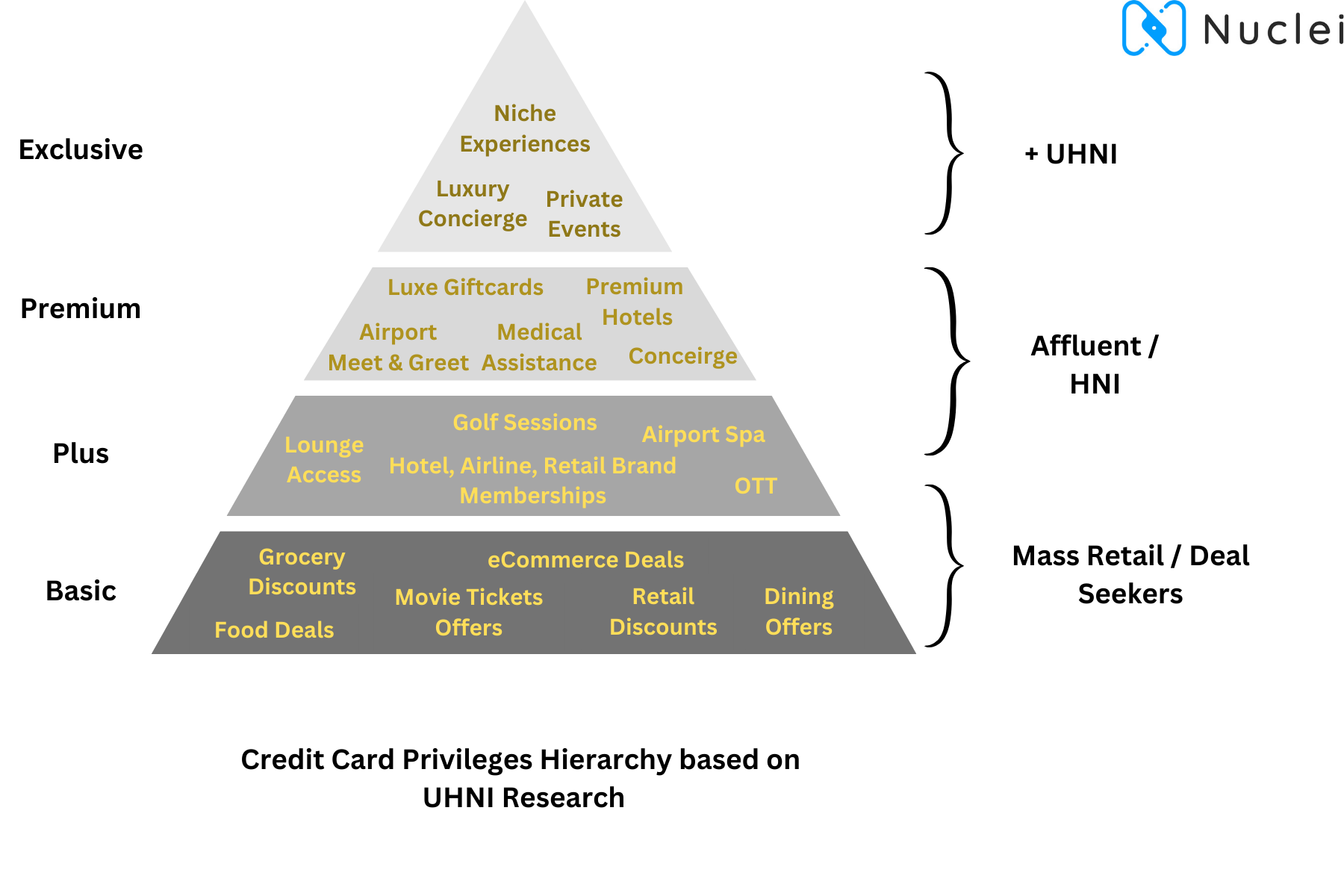

Based on our conversations with UHNWIs, existing offerings of the most premium credit cards and the expectations can be categorized as,

- Basic

- Plus

- Premium

- Exclusive

Basic: These are the standard offerings included with every credit card by a bank. These pretty much follow the pattern of access to banking products like higher credit limits, unlimited withdrawals from any ATM of any bank, discounted locker facilities, and free cheque collection along with discounts to services and products of necessity. The typical lifestyle offerings would cover discounts on food & grocery delivery, eCommerce, movie tickets, and travel booking sites. Though not exclusive or premium, these offerings need to be covered before moving to higher ones. The benefits covered here would generally be a deal-seeker's delight.

Plus: This level covers slightly higher privileges that extend to travel, dining, stays, and security (read insurance, assistance). Airport lounge access and Golf session privileges are identical for every card. As this article says in many more words, these are no longer considered a luxury with UHNWI opting to skip the waiting lines and crowded spaces of lounges. Even the hotel memberships or offers on them are limited to hotel chains slightly above the business segment. Some cards even have set limits on the number of times these privileges can be availed which further dilutes the premiumness as this cohort doesn’t take too kindly to being turned away.

Premium: This is probably where certain banks have leveled-up to cater to the affluent. Some cards offer complimentary airport transfers and meet and greets allowing UHNWIs to skip the queues at airports. A concierge service is available to all cardholders helping them with travel bookings, hotel stay bookings, tickets to events, concerts etc. But most UHNWIs still prefer to engage with concierges directly as most banks are unaware of the choices of events, and restaurants that UHNWI would frequent making the interaction a lot more tedious than it should be. Services like medical concierge, and zero cancellations on bookings are appreciated. Some banks have extended their portfolios to include luxury properties, unlimited spa sessions, and luxe gift cards to brands that they might shop at.

Exclusive: The niche where UHNWIs feel like banks understand and deliver on their needs is still elusive. What UHNWIs need is a sense of belonging with a cohort that shares their elite preferences. Curated access to closed door events, private performances of their favorite celebrities, private dining by Michelin star chefs, luxury travel packages that are outside the purview of mass audiences. Be it a White Desert Camp or an Outer Space travel experience. Top-tier luxury purveyors and expedited immigration fall under this category too. A couple of banks are hosting private events but are very limited in choices and verticals.

A luxury concierge that caters to the most exclusive and elite options could also be an answer to the needs of the ultra wealthy. With dedicated managers who are familiar with the needs of this segment and understand their need for the finer aspects of luxury. Available 24x7 and across channels, they should anticipate the requirements with minimum prompts.

Imagine these as the tiers of a hierarchical pyramid. While the foundational levels are essential for any credit card, the omission of an exclusivity layer implies banks are foregoing the loyalty and engagement of UHNW customers.

Conclusion:

Pioneering a UHNWI Credit Card Segment in Banking.

Amidst increasing global UHNWI expansion, financial institutions stand to gain by recalibrating credit card offerings to align with the distinctive requirements of this super-affluent clientele.

Beyond the standard perks, UHNWIs are inclined towards tailored services that resonate with their lifestyle and financial aspirations. By addressing this gap, banks have a unique opportunity to redefine their credit card portfolios. This could open doors to untapped potential for revenue growth, enhanced customer loyalty, and the overall elevation of banking services within this specialized segment.

Contact us to know more about opportunities that can reshape the credit card landscape and elevate banking services to new heights of exclusivity and sophistication.