Tinkoff is a Moscow-based digital bank founded in 2006. They started this journey with credit cards but soon expanded to debit cards, deposits, and simple transactions.

Between 2000 to 2012, mobile and internet penetration in Russia grew from 4% to 63%. This made apps, digital wallets, and payments ubiquitous. This growth continued, Tinkoff latched and grew leaps and bounds in terms of user acquisition, wallet, and payment volumes.

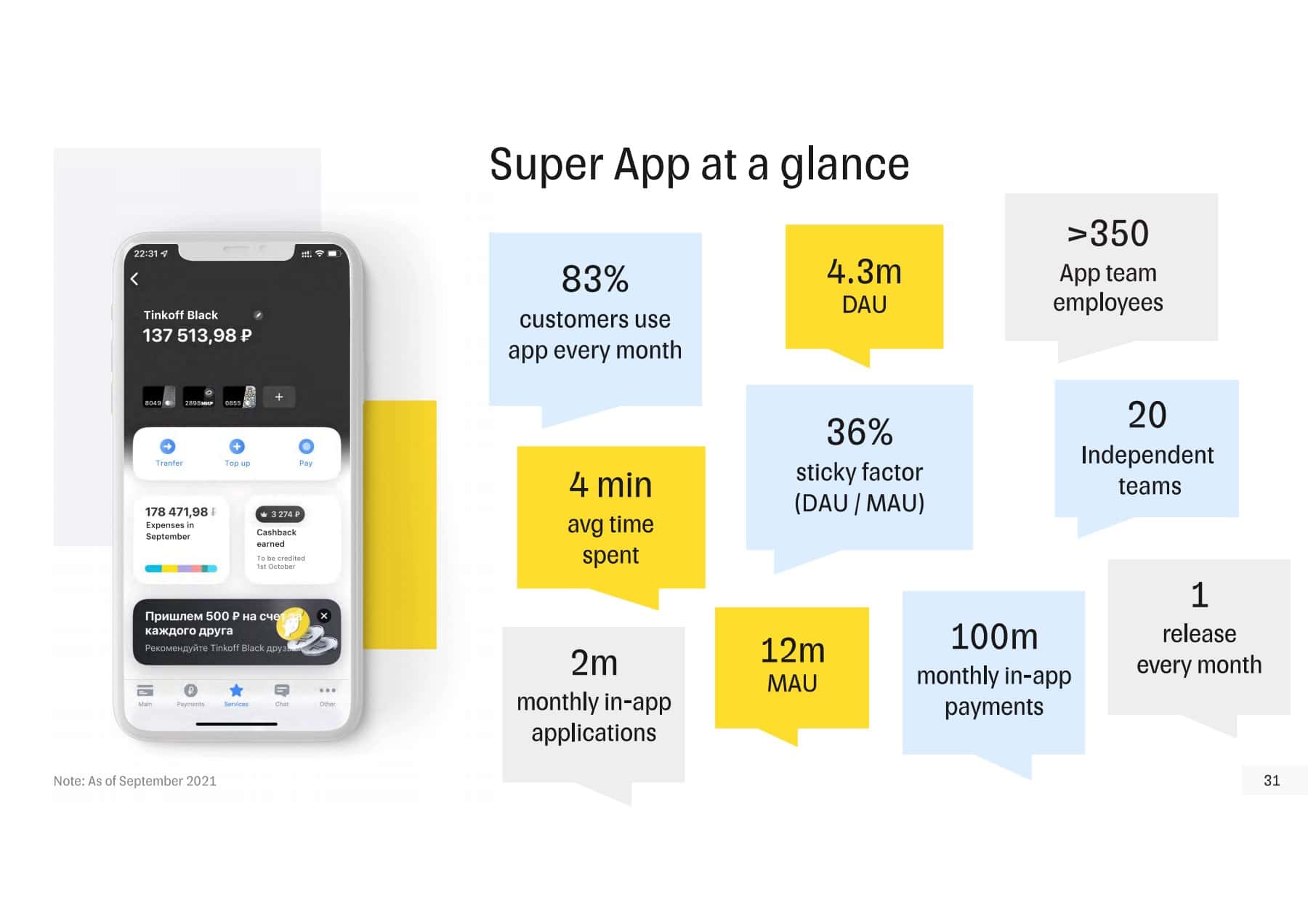

Today Tinkoff is the OG of the super app. The Tinkoff ecosystem comprises not just financial products but full-blown lifestyle banking use cases.

Customers Love Tinkoff

Tinkoff has hooked its customers by giving them a plethora of services to fulfill their needs. Tinkoff's strategy from the early days was to create a super-app, which allowed them better engagement. Customers would find services like

- From loans to lifestyle everything is there in one platform

- Recommendations and guides to the customers about what they can do next with their money (investment advisory)

- Great interface with customization which engages the customers

- Seamless and Cashless payments. Everything is handled online with utmost security

- It has become a one-stop shop or GTM for the customers where they can do multiple things in one go.

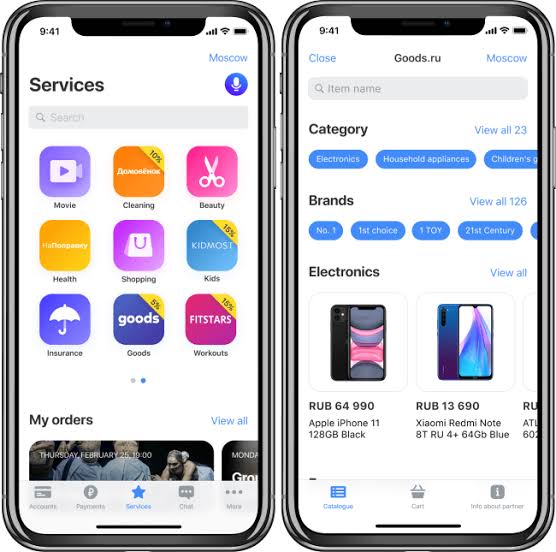

Tinkoff super-app is a marketplace with hundreds of merchants on the platform. It showcases merchants' offerings like health & beauty, food & delivery, ride-hailing, entertainment, culture & education, fitness, cleaning, and many more. Tinkoff is a leading fintech innovator in Russia.

Apart from lifestyle banking, they have many other features in their Super-App which include 1. Daily Banking: All financial products of the bank, discovering other new products, ordering documents, 24/7 live chat support, Apple pay, Samsung Pay, Google Pay (which facilitates easy transactions for a variety of different users), crowdfunding, etc. 2. Payments and transfers: Quick payment system, government services, traffic police fines, subscriptions to accounts from government agencies, payment automation, QR code operations, unique Tinkoff ID, wallet with ecosystem products, etc. 3. Tinkoff Junior: Banking for children from 7 years old, child geolocation, standalone Tinkoff Junior app, baby lifestyle services, etc. 4. Bonuses: Management of cash backs, bonuses, points, lifestyle cashback, special offers, voice assistant Oleg, Tinkoff stories, targeting individuals with offers (like cashback up to 30% in machine learning), biometrics in the application, etc.

(Source of image: Tinkoff business strategy)

(Source of image: Tinkoff business strategy)

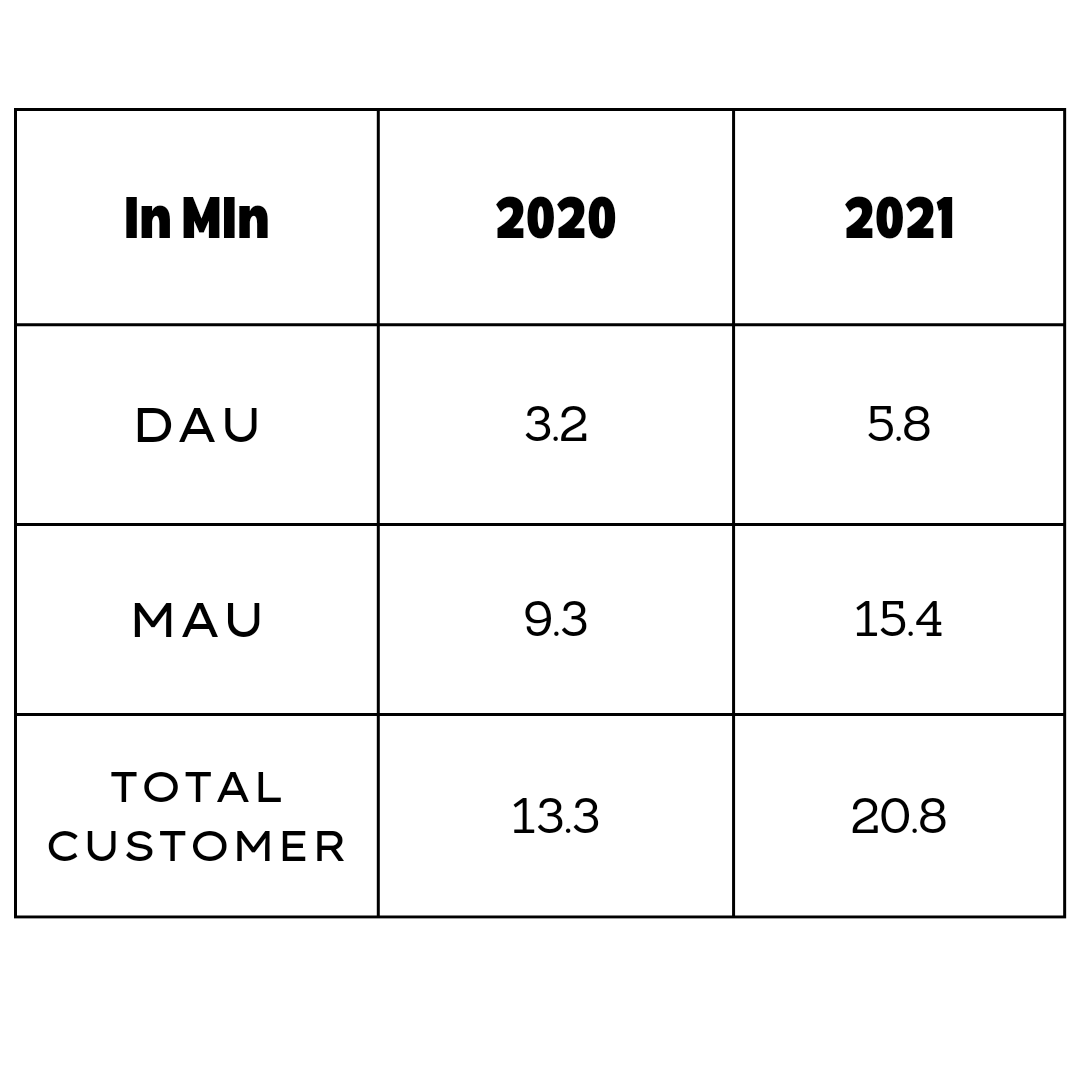

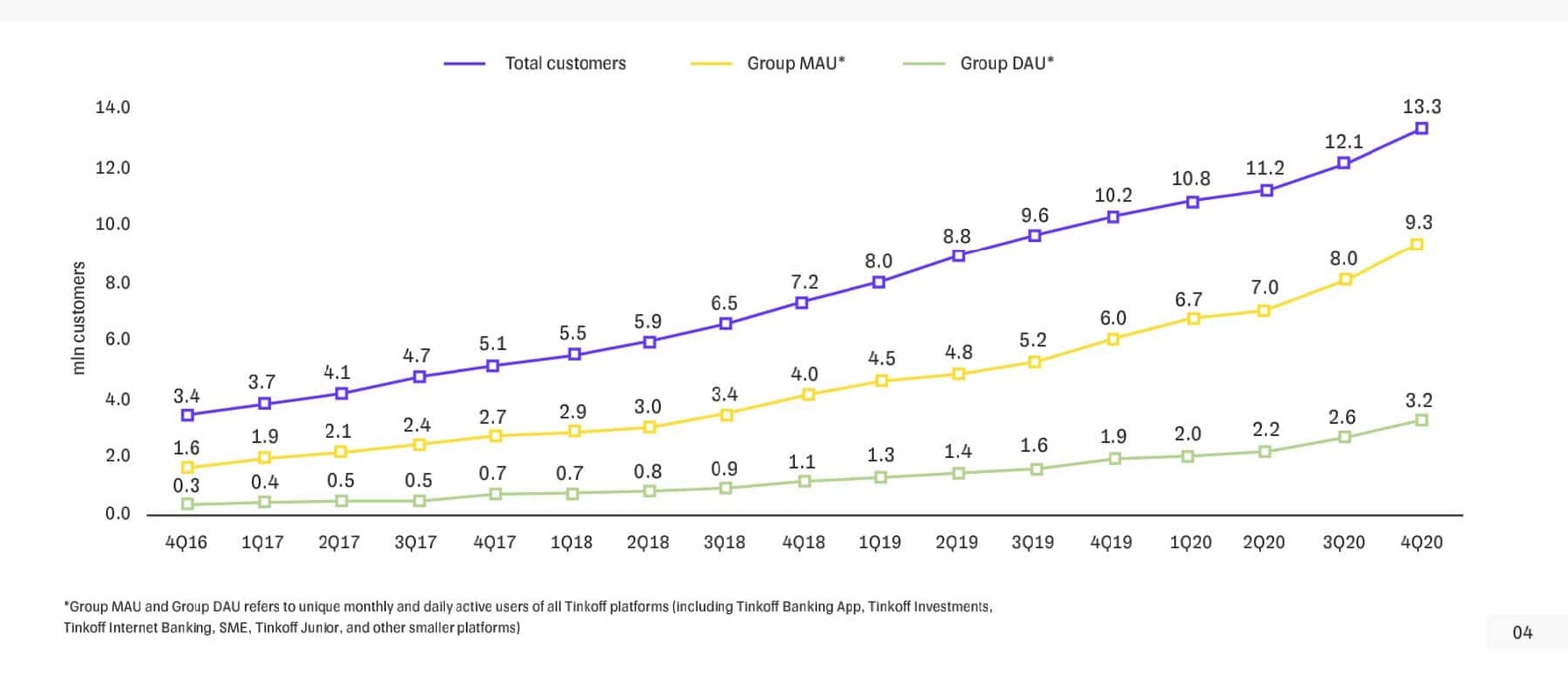

Growth Story of last 5 years

Talking about the growth of Tinkoff, it has achieved several milestones over the course which includes

(Data source: Tinkoff strategy)

(Data source: Tinkoff strategy)

- The range of customers also varies from

- Medium business 10K active customers with 7 million (Russian currency) avg. monthly turnover

- Small legal entities 46K active customers with 900k avg monthly turnover, and

- Small & micro (individual entrepreneurs) 255k active customers with 350 million monthly turnovers (35% females and 65% males).

(Source of image: Tinkoff business strategy)

(Source of image: Tinkoff business strategy)

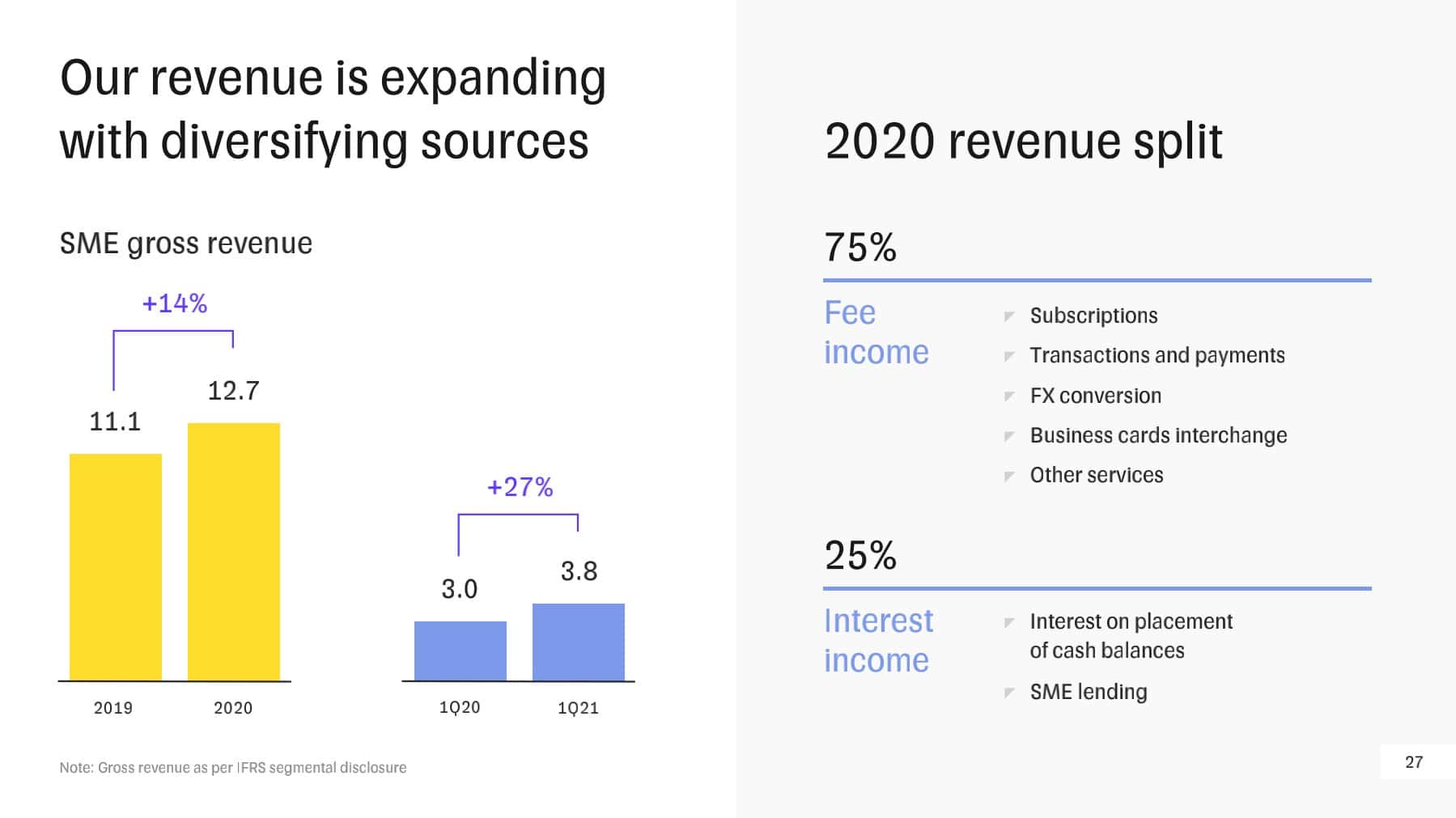

If we look at the 2020 revenue split, then

(Source of image: Tinkoff business strategy)

(Source of image: Tinkoff business strategy)

What’s in it for banks?

Where on one side digital banks are focusing on building super-apps, traditional banks are still the same. Adopting some of their strategies like using biometric technology or seamless integration, lifestyle banking, junior banking, and many more, would make the process smooth sailing for the ‘traditional’ customers.

To help the banks come up to the surface, companies like Nuclei provides solution for each one of them as the products and services are meant for different generations all around the world which can make a normal banking app a Super-app! It can help the banks build their own super-app products for lifestyle banking.

Banks and their services have become outdated and it demands a change. Now is the time for them to evolve. Otherwise, the day is not too far when the neobanks will take over the traditional banks completely all over the world.

Reference- presentations link.