GCash is one of the biggest E-wallets in the Philippines. It started with the aim to make everyday payment easy with the help of partner wallets (like Express pay, true money, etc.) and partnerships with merchants which enables access to lifestyle features for many Filipinos. The company began its journey in 2004, as 80% of the Filipinos were unbanked due to a lack of documents, money, and awareness. Globe telecom explored the space and gave rise to GCash which is backed by Mynt. Initially, GCcash had only SMS based money transfer service. As the mobile penetration increased, so did the e-wallet features. GCash sped up the adaptation of mobile payment, especially during the pandemic. In 2017, it started to become a super-app and currently, the only unicorn company in the Philippines.

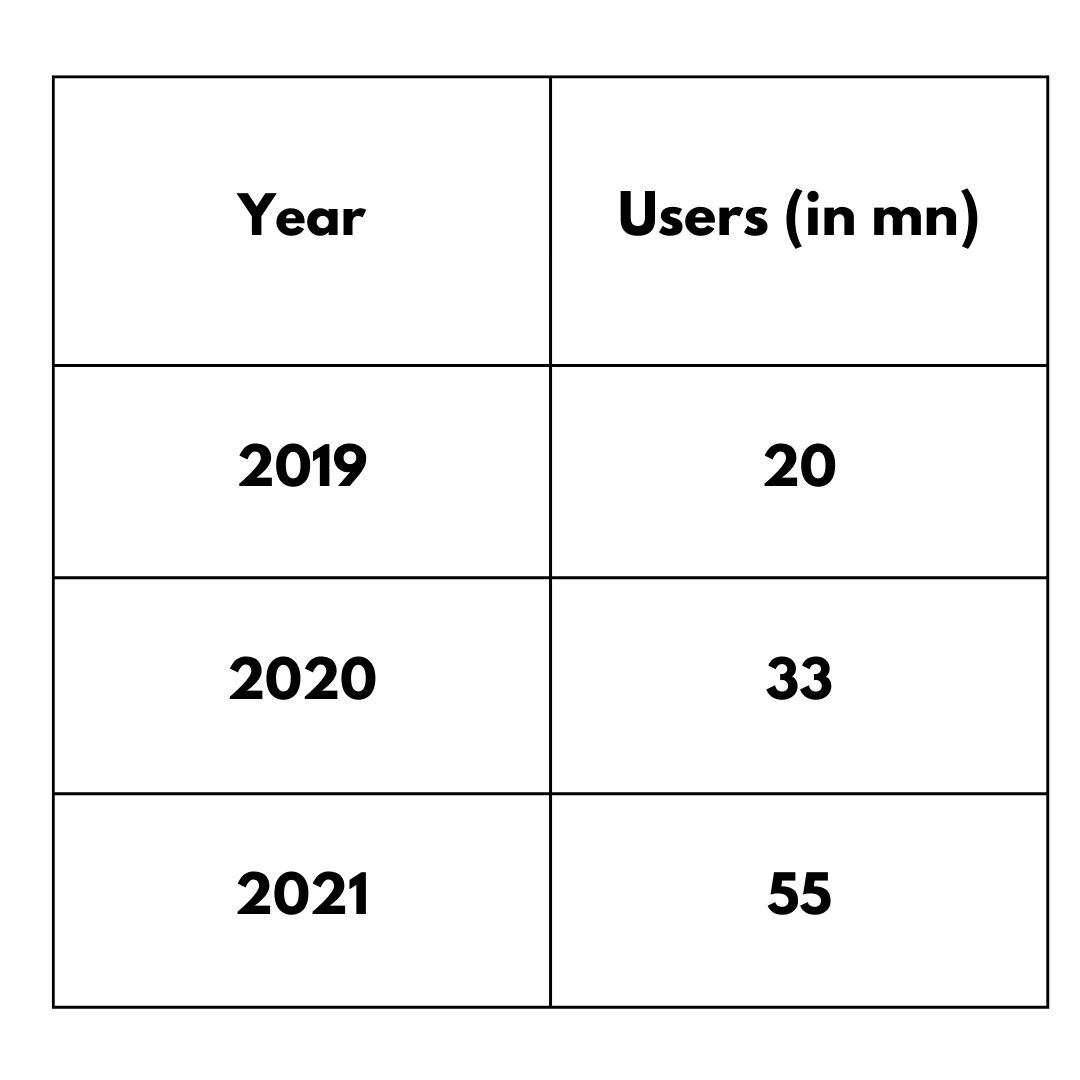

GCash registered users

According to Global Fintech innovation, 70% of the adult population in the Philippines uses GCash e-wallet services. The number of registered users from 2019 to 2021 has grown exponentially.

- As of 2021, daily active users stand at 23 mn, and monthly active users have grown 3.7x from 2020.

- The company recorded 17 million peak daily transactions last year in 2021, higher than 6 million daily transactions in 2020.

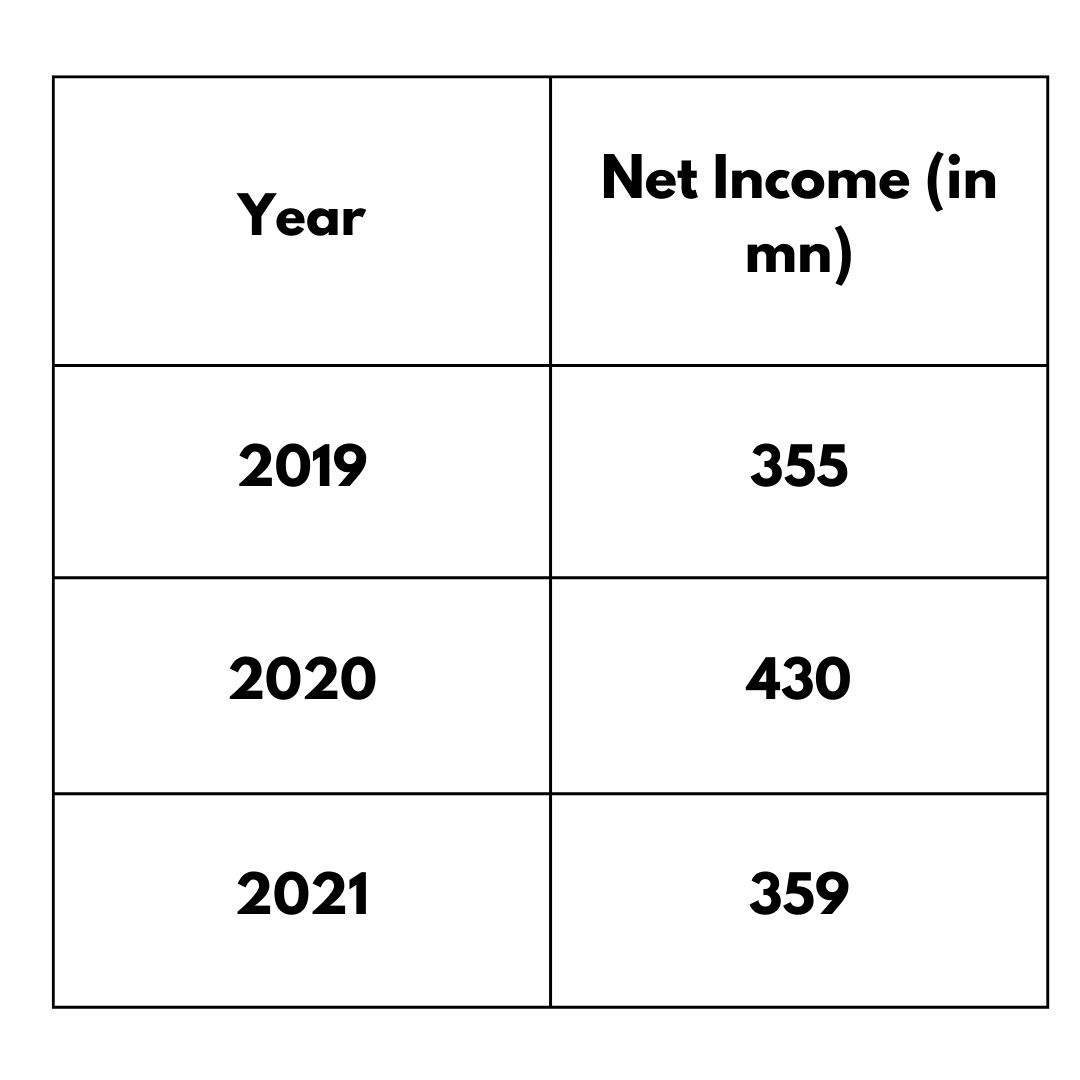

GCash net income

The net income generated from 2019 to 2021 is as follows

Mobile wallet GCash has more than tripled its gross transactions to $74 bn USD in 2021 from $23 bn in 2020.

“GCash has played an integral role in keeping not only the economy going this year but keeping Filipinos safe and sane during the pandemic. We’ve seen not only heads of households and young adults use the GCash app for their financial lifestyle, but even consumers that advocate a greener Philippines, in maximizing what our platform has to offer,” said Martha Sazon, President and CEO of GCash.

GCash e-wallet has over 139,000+ merchant partners, 400+ billers, and 300 Glife partners nationwide.

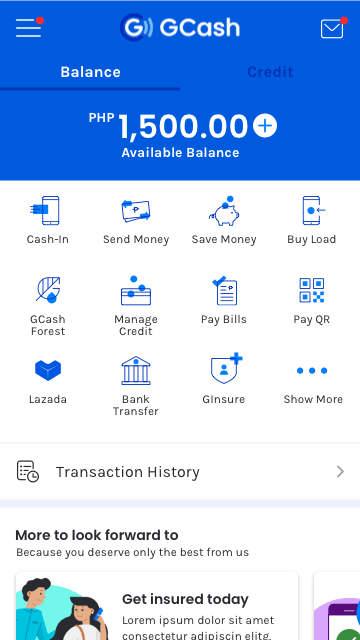

GCash Super-App features

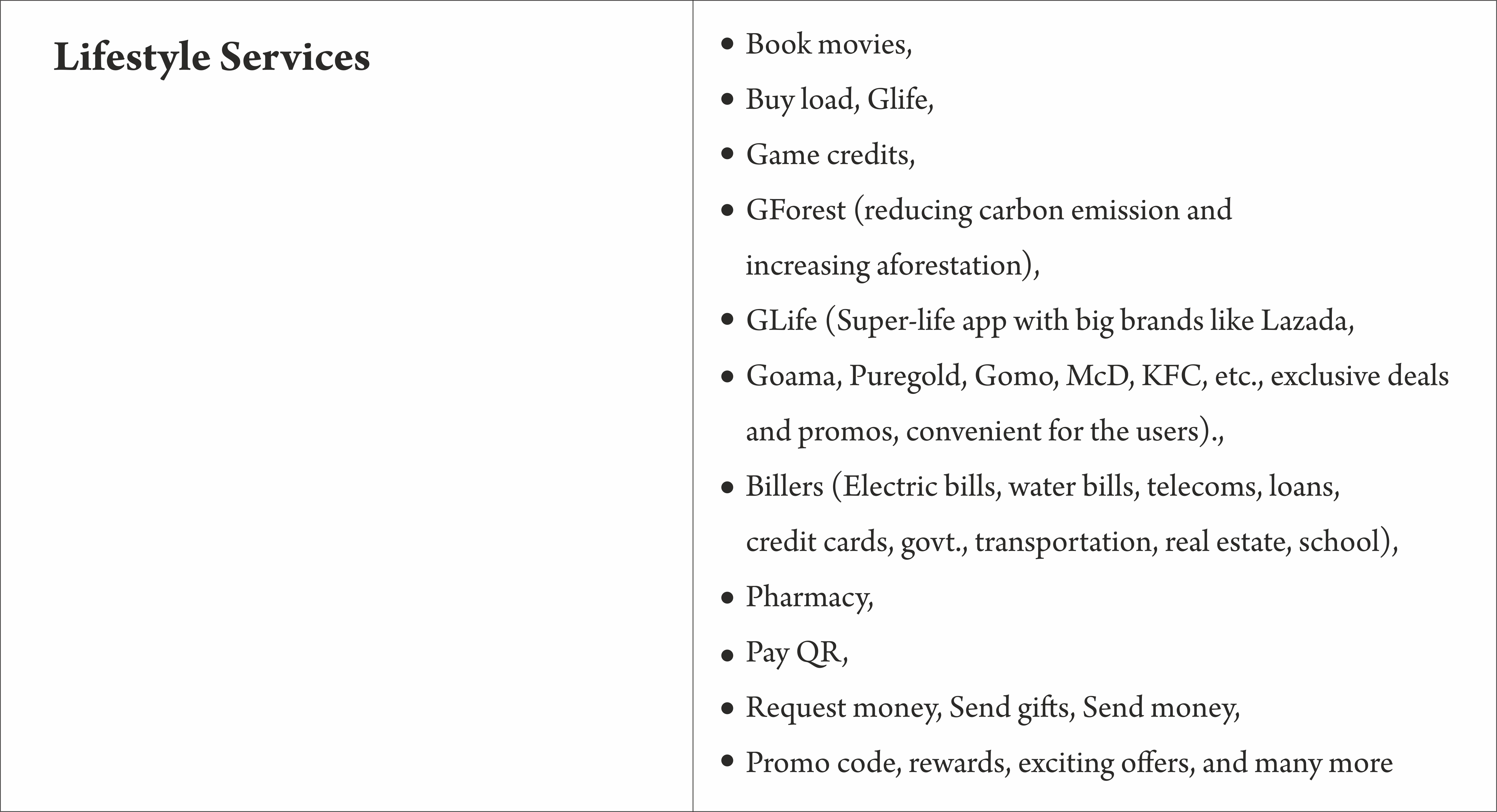

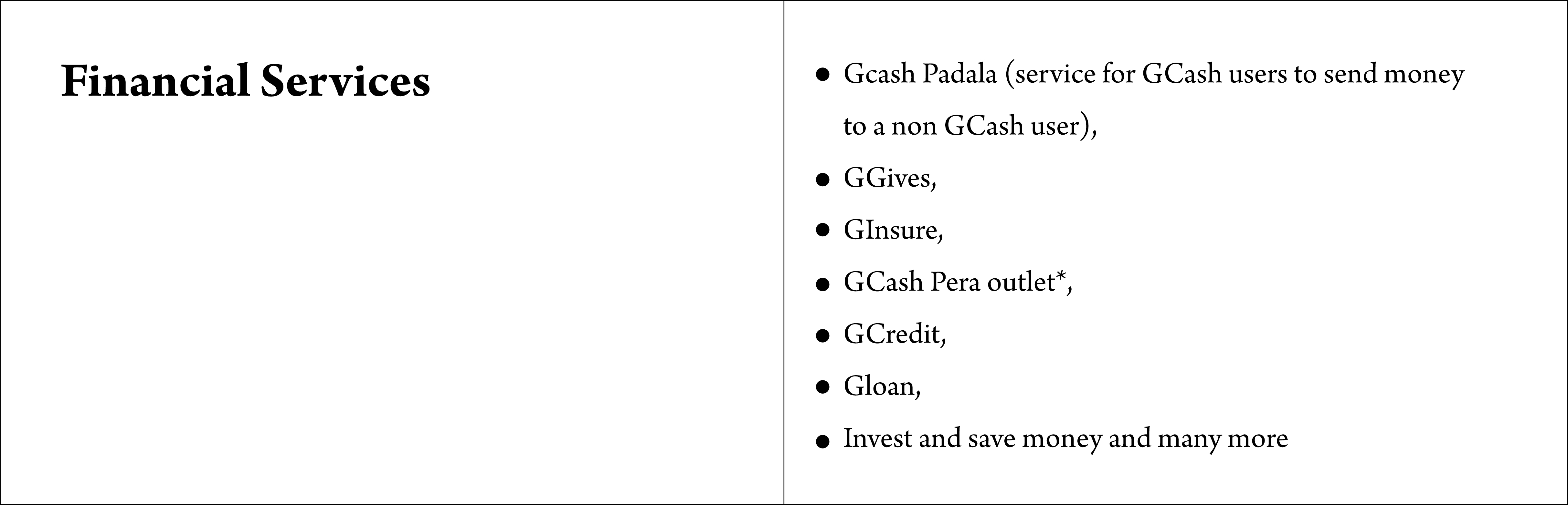

GCash super-app has all the features tailored specifically for Filipinos. From lifestyle services like online shopping, and daily transactions to financial services like investment, and insurance, they have everything in one app, thus making everyday life smooth.

Here are some of the key features in the super-app:

GCash Pera outlet* = a new way for sari-sari store (convenience store) owners to grow their business.

GCash Pera outlet* = a new way for sari-sari store (convenience store) owners to grow their business.

One of the biggest advantages of GCash Padala is that the sender does not need to queue in padala centers to send money. They can send money anytime, from anywhere within a few seconds! A great step in an evolving market!

With these many features, customers tend to carry out their lifestyle activities with one single app, thereby increasing the engagement and retention of e-wallets.

“As GCash became more and more indispensable in our daily routines, usage also grew. Customers now use our app more than two times daily, paying for food, utilities, and online shopping,” said GCash president and CEO, Martha Sazon.

GCash experienced an improved net promoter score from 63 percent in January 2021 to 75 percent in March 2021.

Engagement analytics

GCash’s user engagement also continued to grow, with the app being used on average more than 2.5 times a day by active users. Daily logins have peaked at 23 million in 2021. Total visits

- December 2021- 9 mn

- January 2022- 8.9 mn

- February 2022- 7.1 mn

- Bounce rate- 51.01%

- Global ranking- 8331

- Country rank- 76

(Source)

(Source)

By 2023, 50% of total retail transactions in the Philippines will be done through digital, and 70% of the Filipinos will be financially included, Central Bank of Philippines predicts. About 36.9 mn Filipinos are unbanked, it is now going to be changed because of the digital transformation in the fintech industry. All because of the rise of super-app in the Philippines which is making everyday life easy for the consumer.

More reference.