Paymaya and Gcash are two of the major E-wallets in the Philippines which started around 2007 and 2012 respectively. Companies began with the mission of making daily lifestyle easy with the help of Super-App, where one can avail of all the services on one platform. From lifestyle to financial products, they have everything.

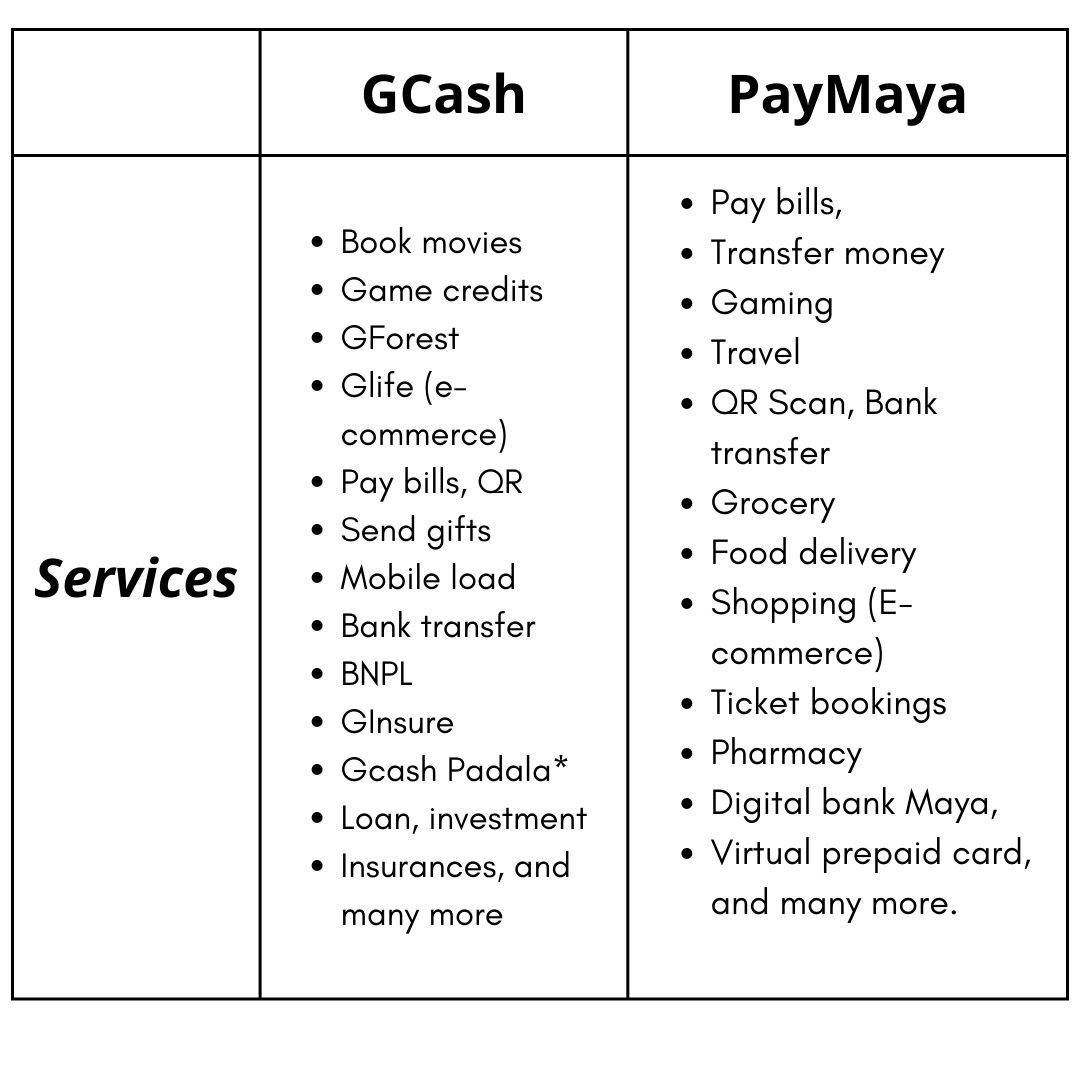

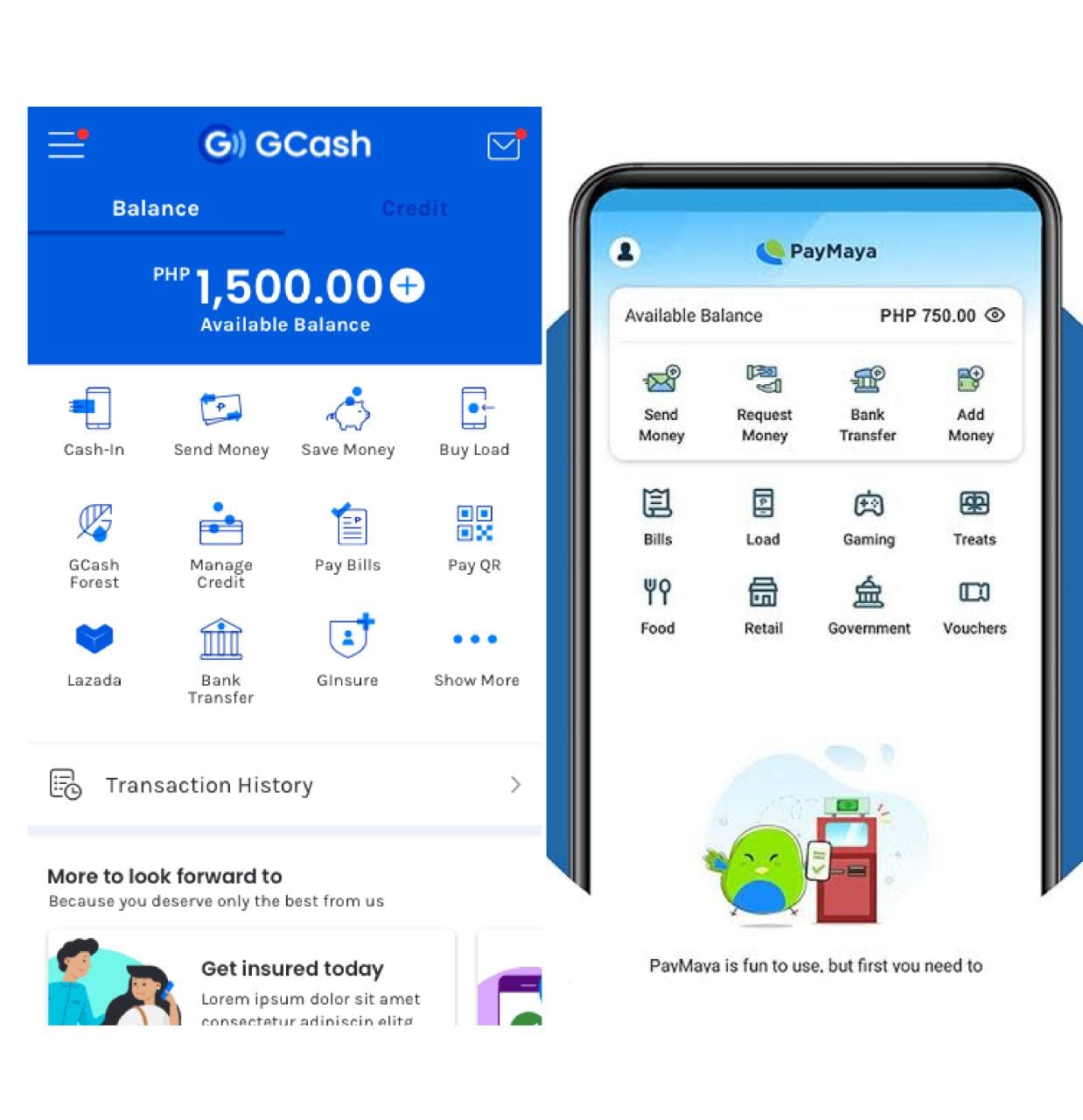

Gcash is the country’s largest mobile e-wallet service that continues to expand in the Philippines. PayMaya is also one of the most popular financial “super apps” in the region. Some of the common services are digital wallets, online remittances, bill payments, bank transfers, prepaid cards, e-commerce features, and many more.

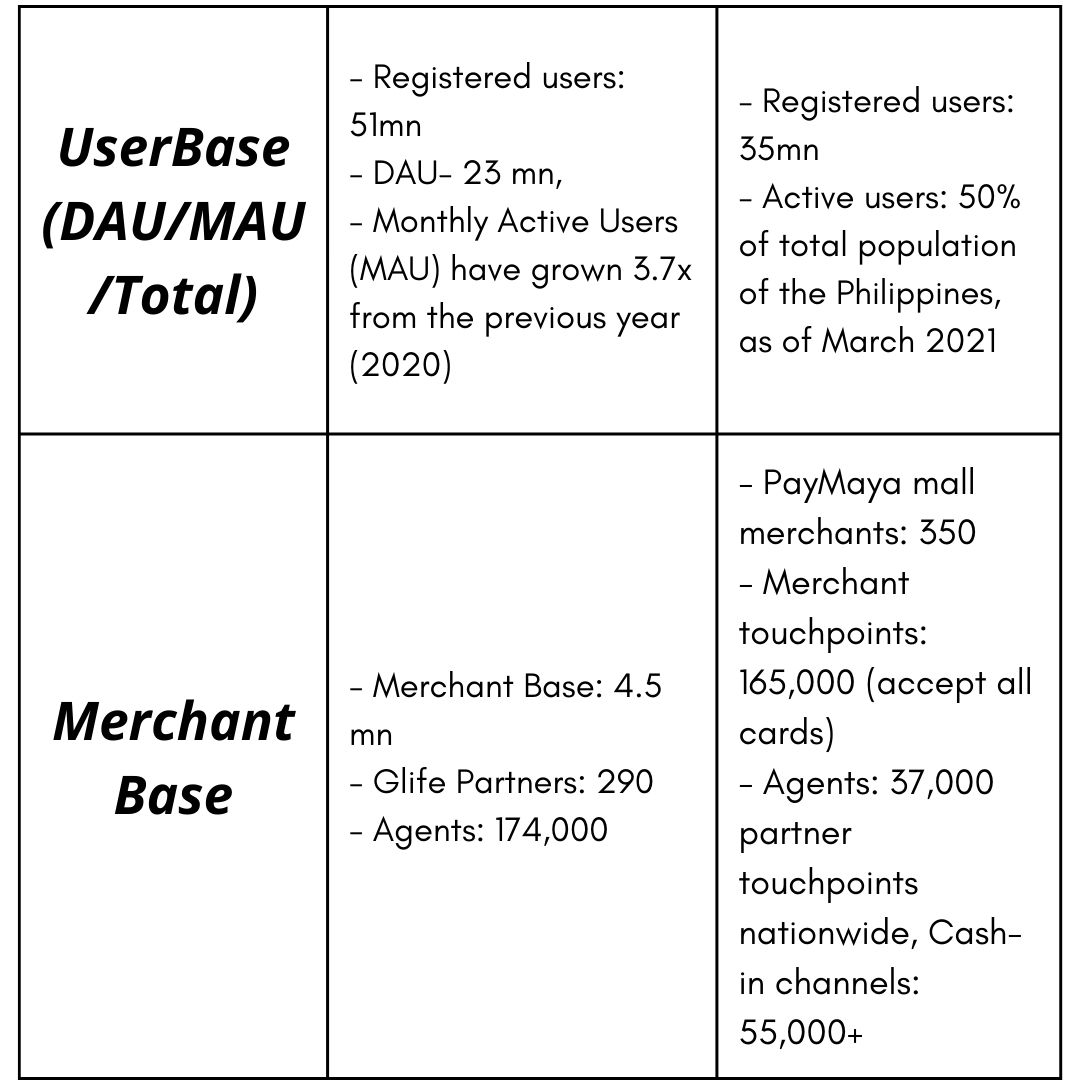

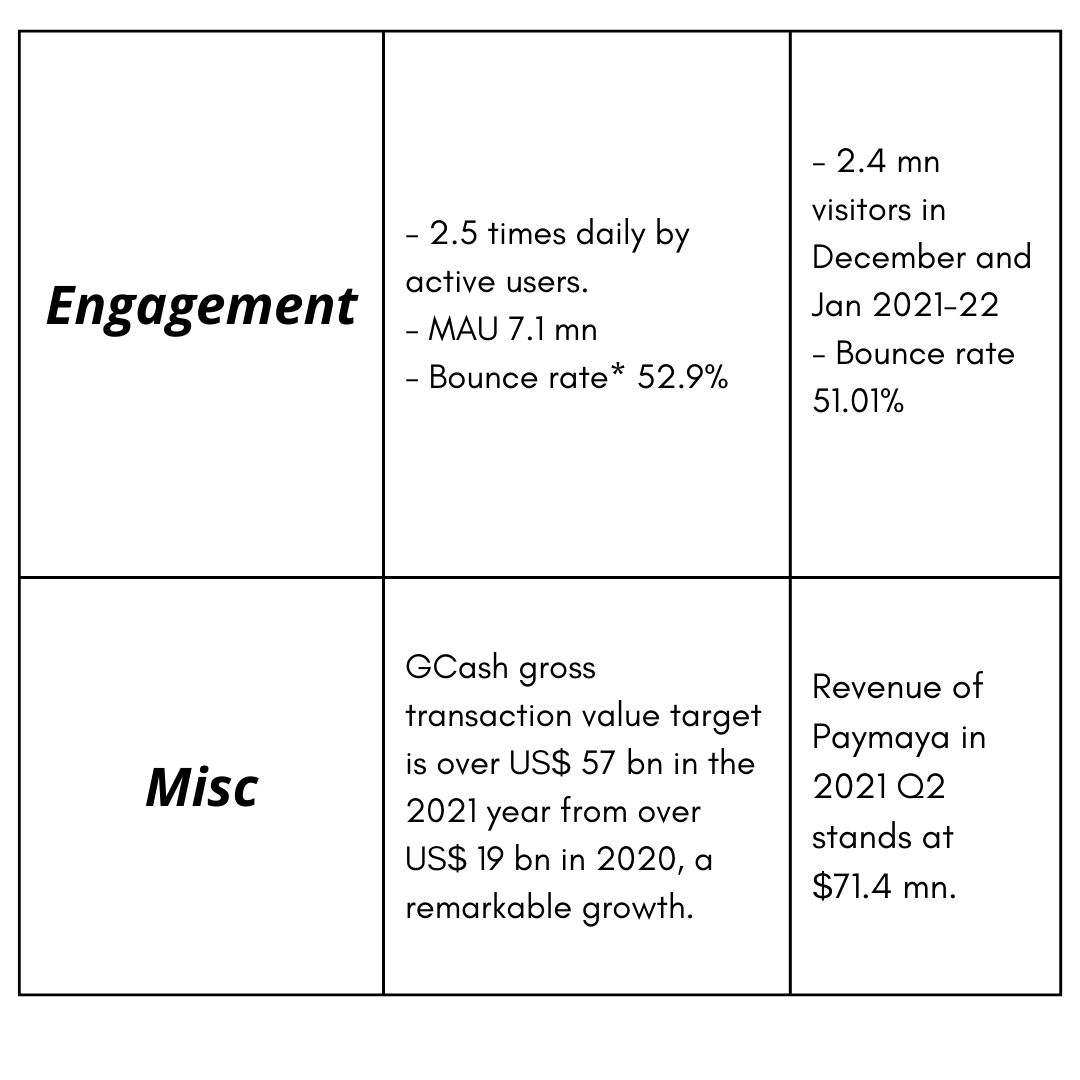

Let’s have a look at some of the stats of both the application and how they differ from each other in terms of the user base, revenue, engagement, and many more.

*Bounce Rate- Percentage of visitors on the site/application

*Bounce Rate- Percentage of visitors on the site/application

Engagement rate of both E-wallets (Source of Image)

Engagement rate of both E-wallets (Source of Image)

Few more facts:

- GCash also became the only double unicorn in the Philippines, reaching a valuation of over $2 billion.

- Paymaya’s mobile wallet remittance has doubled to 38 mn within a span of 18 months, as of 2021, making it one of the most used super-app in the Philippines.

- GCash experienced an improved net promoter score from 63 percent in January 2021 to 75 percent in March 2021.

- MayaBank (Philippines digital bank) backed by Paymaya is set to launch by Q122, offering specialized lending and deposit products for consumers.