In recent years banks have embraced digital and fintech innovations at a rapid pace. This evolution is driven primarily by a commitment to enhance customer experiences, optimize operational efficiency, and maintain a competitive edge in the dynamic financial services landscape.

Digital transformation though comes with the prerequisite responsibility of ensuring robust cybersecurity and strict compliance. Stringent regulations are required to maintain trust and security in the digital age.

This blog cover will give you a brief overview of the below topics in the scope of banking tech -

- Current Digital Banking Landscape.

- Is cybersecurity an afterthought?

- Steps to ensure “Secure Digital Banking"

Banking in the Modern Age: Adapting to Evolving Expectations

Traditional banks are consistently shedding their legacy image to meet changing customer expectations. They wholeheartedly embrace digital technology and fintech innovations to stay relevant and hold a competitive edge. A few places where this is obvious -

- User-Centric Apps and Websites: Newer versions of website and app interfaces to enable seamless access to the comprehensive range of banking services.

- Super App Transformation: Integration of lifestyle categories such as travel, shopping, gift cards, etc. offering customers security and convenience in transactions

- Deals and Exclusive Offers: Banks have developed platforms that enable customers to explore and access exclusive deals and offers.

- Loyalty Points: Partnerships with platforms that help manage and redeem reward points to delight and engage members

- Adopting New-age Tech: Tireless innovation, and integrating new technologies like Blockchain, AI/ML, Biometrics, UPI, ONDC, CBDC, etc. for better user experience.

Where does cybersecurity feature?

A recent Global Fraud and Payments Report highlights an alarming trend of rising cyber threats every year. Notably, the BFSI sector finds itself a prime target for cyberattacks and data breaches (ref this report and this report)

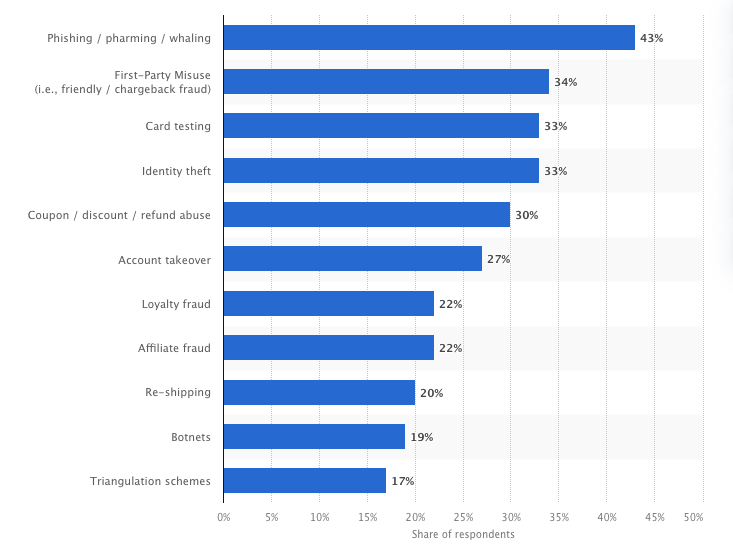

Phishing/pharming/whaling have emerged as the most common types of fraud faced by digital businesses worldwide.

Source: Statista

Source: Statista

Recent reports of scams, frauds, and cyberattacks on banking digital platforms and services are revealing the extent to which financial platforms are vulnerable to cyberthreats and the ingenuity of hackers in finding every minor vulnerability e.g. 1, 2, 3.

This is bound to raise questions like - Is cybersecurity an integral part of a bank's digital roadmap? It definitely can’t be an afterthought as it leaves open certain vulnerabilities which may seem insignificant at a later stage.

How can Banks Secure Digital Banking?

The scope of this topic is too vast to cover in just this blog in its entirety. Considering Banks have a wide range of digital solutions and platforms, the measures would be as comprehensive and advanced as the system. In this blog, we will cover a basic framework on how Banks can approach cybersecurity while not compromising on their innovation of new solutions.

Threat Modelling is a necessary step for every system right at the planning stage. Be it an in-house development or a solution from a fintech partner (via redirection or embedded), the bank has to spend time on this modeling before moving into implementation

A few critical aspects that should be part of your cybersecurity checklist:

- Critical data security: Identify types of data being handled and attribute the level of security required. Personal data and Financially viable data (like voucher codes, coupon codes, and cashback), etc. should be encrypted both in transit and at rest with the best level of encryption standards. Creating a DMZ(Demilitarized Zone) Network along with a WAF (Web application Firewall) can provide a greater level of network security. TLS for communication between client and server and mTLS(mutual TLS) for server-to-server communication is essential for transport security.

- Endpoint and user management: A secure user management solution using biometrics, 2FA, etc. methods should be implemented to avoid identity theft. The computing endpoint used by the user (mobile, tablet, or laptop) should also be inspected automatically to ensure that the customer's device is not compromised. Safe SSL Pinning, Protection from cookie Poisoning, and jailbreak detection should not be skipped.

- DevSecOps and Secure Development Practices: Integrating security into the DevOps pipeline is crucial for proactive threat mitigation. Implement a DevSecOps approach, ensuring security is considered at every stage of the software development lifecycle. This includes code analysis, vulnerability scanning, and automated security testing (VAPT, etc.). DevSecOps practices help identify and address security issues early in the development process, reducing the risk of vulnerabilities in production. Secrets and credentials access and management should be done using “Key Vaults”. Android, iOS, and Web development security best practices should be part of the development and code review process

- Monitor, Detect, and Mitigate: Continuous monitoring is key to identifying and responding to cyber threats swiftly. Employ advanced threat detection tools and Security Information and Event Management (SIEM) systems to monitor network traffic and system logs in real-time. Anomaly detection using AI/ML can be used to early detect any cyber attack or fraud. Establish an incident response plan that outlines procedures for identifying, mitigating, and recovering from security incidents. Regularly conduct simulated security drills to ensure the effectiveness of the response plan. Knowledge and implementation of MITRE ATT&CK framework, OWASP, etc. are essential. Threat Intelligence can be improved by subscribing to various countries' authorized CERT(Computer Emergency Response Team) and various other Security advisory agencies.

- Compliance, Regulation, and Awareness: Staying compliant with cybersecurity regulations is not just a legal obligation but also a fundamental security practice. Keep abreast of relevant industry-specific regulations such as the DPDP Act, GDPR, HIPAA, or PCI DSS, and ensure that your cybersecurity practices align with these requirements. Regularly audit and assess your security posture to identify and address compliance gaps. Collaborate with legal and compliance experts to ensure full adherence to all applicable regulations and standards.

Cybersecurity due diligence is non-negotiable when embracing innovation in banking operations. Banks must assess risks, ensure compliance, implement robust security measures, and prepare for incident response. By prioritizing cybersecurity, banks can harness the benefits of fintech innovation while safeguarding their customers' financial data and trust.

We have built a robust checklist in-house, which covers all the best practices that we have gathered over the years working with banking institutions. We ensure to stay abreast of any new developments in the security industry and incorporate them into our practices. Reach out to know more.