In our last blog on junior banking, we talked about the market trends in the junior banking industry and its long term implications on banks across the globe. We also touched upon the existing gap in the market in terms of lack of products built for the junior segment, and what bankers can do to capture the market or risk losing it to new-age tech companies. For more details, you can read that blog here

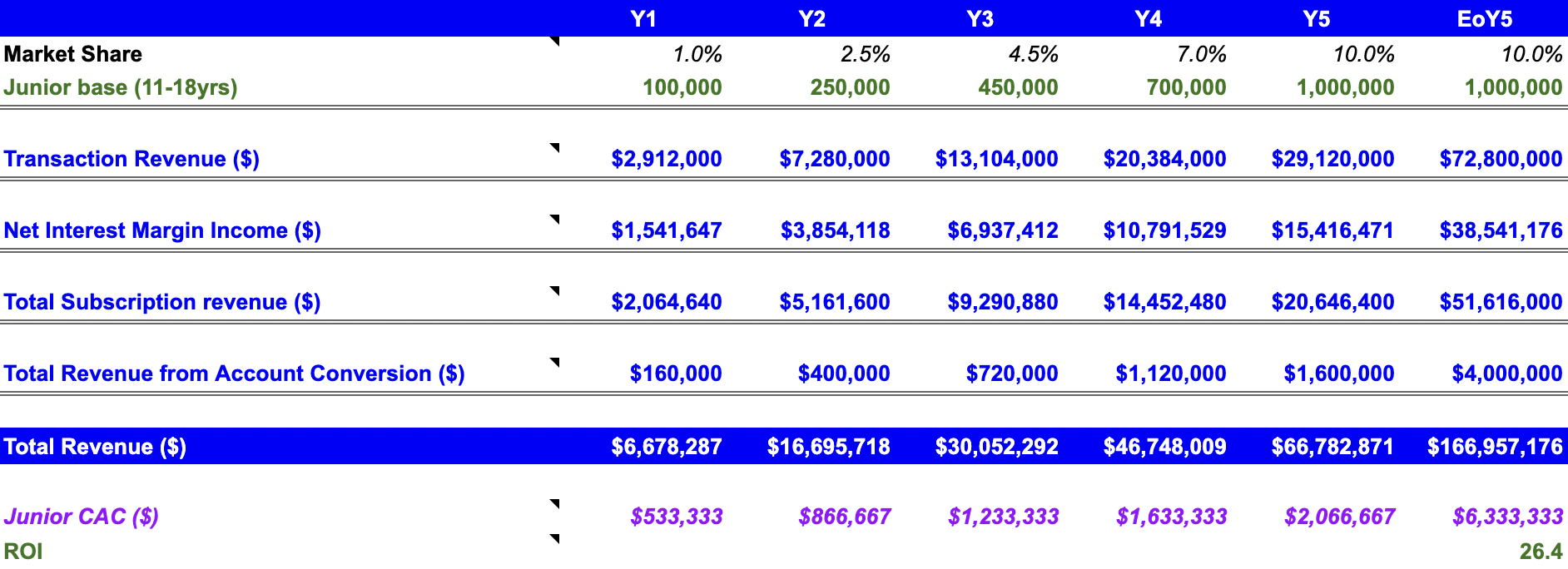

In this blog, apart from certain obvious long term gains, we will attempt to showcase the short term revenue that a junior banking product could generate for your bank over the next 5 years. As a bonus, we will attach an excel spreadsheet at the end of the blog, so you can modify our assumptions and calculate how much revenue your bank could potentially generate.

What is the revenue potential of a junior banking product?

Banks could generate revenue from junior banking in 4 primary ways

- Transactional Revenue

- Net Interest Margin Revenue

- Subscription Revenue

- Revenue from Account Conversion

Each of these depends on one common factor, i.e the customer base. Given that not many banks/fintechs are focusing on this segment, you have the early mover advantage and could easily grab a majority share of the addressable market segment. Addressable market share would depend on various factors including target age group, population, income level, income distribution, literacy level, mobile penetration etc. Potential is limitless and specific to the size and capabilities of different banks. While one bank captures 10%, another could capture 30%. Now, Let’s dig into each of them in detail

Transactional Revenue

‘Transactional Revenue’ is the revenue the bank generates from interchange fees. Interchange fees are transaction fees that the merchant's bank account must pay whenever a customer uses a card to make a purchase from their store. The fees are paid to the card-issuing bank. To calculate the spend made on these cards, you need to know the average pocket money received and how they are used.

A good rule of thumb is the 50/30/20 rule: This rule budgets your money based on the following percentages: 50 percent for necessary expenses, 30 percent for other expenses, and 20 percent for savings. For teens, savings can be increased as they don’t have to pay bills, savings can also be incentivized by building good experiences like saving pot.

Transactional Revenue = (Interchange Fee (%)) × (Customer Base) × (Annual Spend/Customer)

Net Interest Income

Interest income is the primary way that most commercial banks make money. Banks also don’t need to pay interest to the user because junior accounts would work on top of prepaid cards. The difference between a bank’s lending rate and borrowing rate is known as the Net Interest Margin. Teens, on an average, can save upto 20-30% of their pocket money, which can be further incentivized by parents paying interest on money saved by kids, and similar experiences directed towards making children aware about concepts like fixed & variable interest rates, the effect of compounding, debt, equity and more.

Net Interest Margin Income = (Net Interest Margin (%)) × (Customer Base) × (Annual Savings/Customer)

Subscription Revenue

Customers would pay a fixed amount on a monthly basis to use the junior banking app and card. Greenlight (US-based unicorn - ~4mn customers), Gohenry (UK - ~2mn customers) and other fintech companies have been successfully working on a subscription model for some years now - they charge anywhere between $4-$13 per user per month. Taking that as a base you can arrive at the corresponding price suitable for your market by using the Purchase Power Parity framework.

Subscription Revenue = (Subscription Fee per user per year) × (Customer Base)

Revenue from Account Conversion

Revenue from Account Conversion is further divided into 2 parts

Customer Acquisition Cost(CAC) Savings

When junior banking users turn into adults, they are much more likely to stick and open an account with the same bank. Banks would not have to spend additional marketing dollars to acquire these customers. CAC for the banking sector is among the highest across all industries, ranging from $200-$1000 for adults, whereas CAC for junior’s is ~ 15-25% of it. The extra customers you’ve acquired because of the junior products is the your net revenue from CAC saving

CAC Savings = (Net Junior Account Converted) × (CAC of Adult Account)

Revenue from Adults Account

The Average Revenue generated by 1 adults account from regular banking activities like credit cards, loans, deposits etc multiplied by the new customer acquired because of junior banking is the Revenue from Adults Account

Adult Account Revenue = (Avg. Adult Account Revenue) × (No. of User Converted)

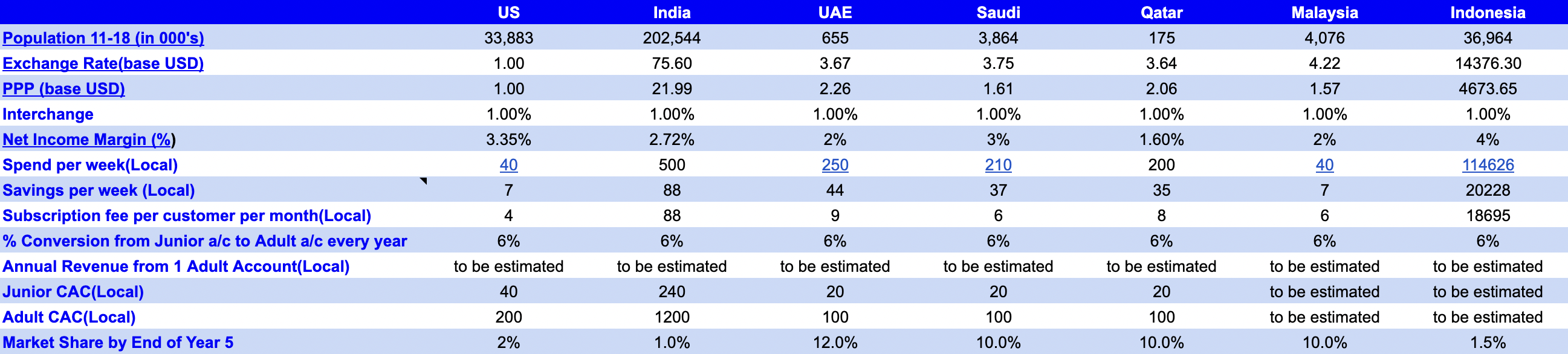

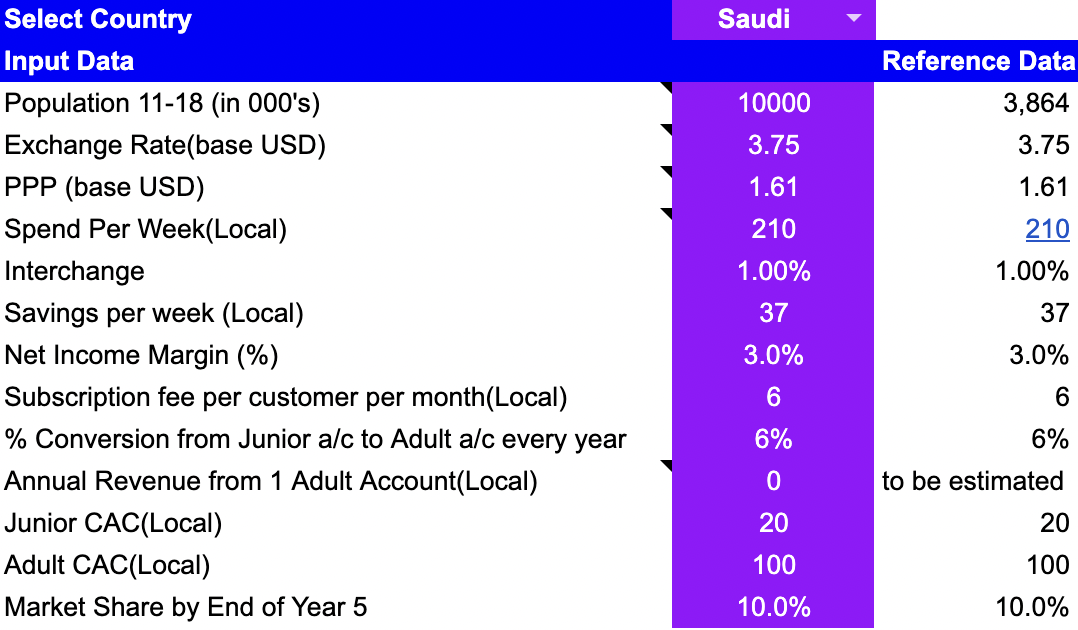

How to use the attached spreadsheet

There are two sheets in the excel

- Data points: Here you can find the list of data points and their meaning with their reference source linked for 6 countries namely India, UAE, Saudi, Qatar, Egypt, Indonesia, Malaysia. Cells with Values “to be estimated” indicate values that need to be provided by the bank.

- Revenue: This sheet has 2 Tables. Table-1 has the reference values that drive Table-2, which calculates Revenue.

Note

- You can Select the Country at Top(Cell B3) to get the reference data for that country in column C.

- Revenue Table is driven from Value in Column B, which by default is linked to Column C i.e. Reference Data.

- Values in Column B are editable, you can change values here manually to input data points applicable to your bank

- Hover over cells to read notes, explaining what each item means and how is it calculated

- Want to make more changes? Go ahead and duplicate the sheet to create your own copy

Download the excel from the link given below and start exploring. To get access to the full version of the excel with cost calculation or any questions or ideas, please reach out to the people behind the research:

Hussain Bohra- hussain.bohra@gonuclei.com Ameen Kropha - ameen@gonuclei.com